Trump's reciprocal tariffs on Philippines to slow subpar 2025 growth—DBS

United States (US) President Donald Trump's reciprocal tariffs on the Philippines could further slow the already subpar economic growth expected this year, according to DBS Bank Ltd. of Singapore.

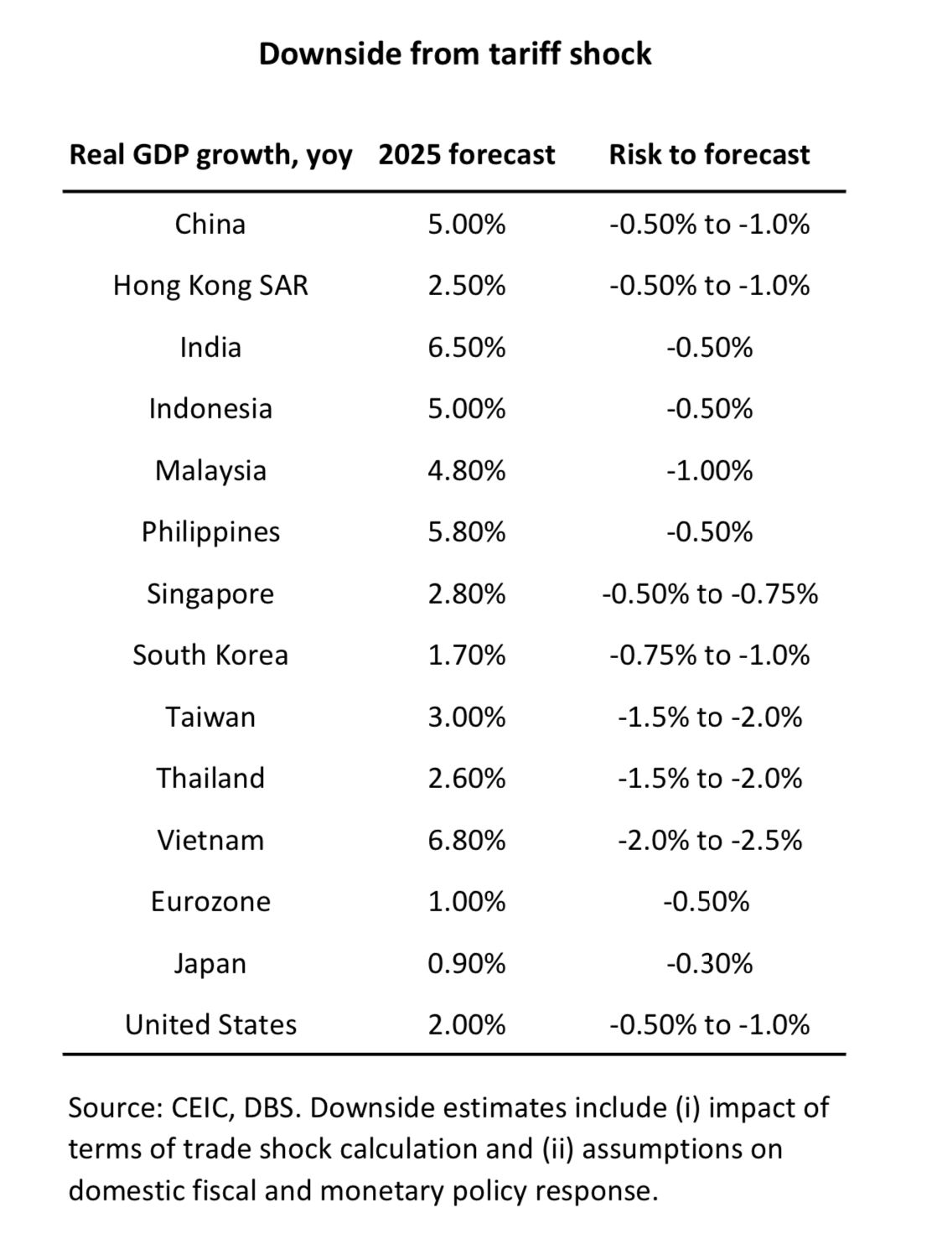

In an April 7 report, DBS Group Research chief economist Taimur Baig and senior economist Radhika Rao estimated that a "tariff shock" on the Philippine economy may reduce the projected 5.8-percent gross domestic product (GDP) growth for 2025 by 0.5 percent.

DBS' 2025 growth forecast for the Philippines is below the government's more ambitious six- to eight-percent goal for this year, following last year's lower-than-expected 5.7 percent.

As such, DBS believes it's time for the Bangko Sentral ng Pilipinas (BSP) to lower key interest rates by 25 basis points (bps) this coming Thursday, April 10, "to backstop domestic growth, amid a challenging global outlook."

This would bring the policy interest rate to 5.5 percent from the current 5.75 percent.

The Singaporean bank expects another 25-bp rate cut in the third quarter of 2025, to end the year with a 5.25-percent policy rate.

It would help that DBS projected headline inflation to ease further to 2.6 percent this year from 3.2 percent last year, within the two- to four-percent target band of manageable annual price increases conducive to economic growth.

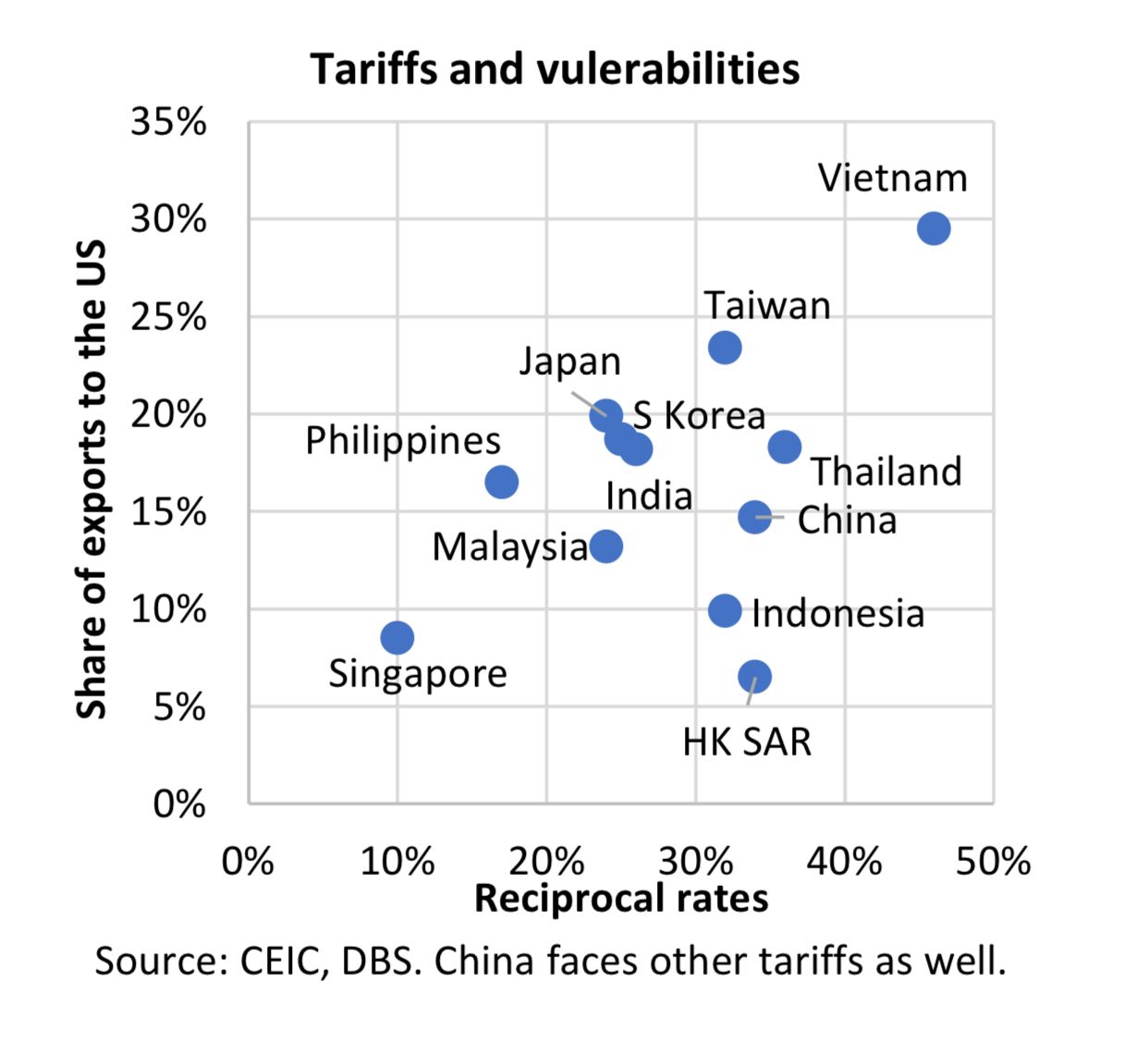

As for the ongoing global trade disruptions, DBS noted that the Philippine government last week "downplayed risks to exports, citing the comparatively lower 17-percent reciprocal tariff on the Philippines, versus most [of its] regional peers."

However, the bank warned that "electronic exports that form the bulk of [Philippine] shipments are likely to be impacted, apart from apparel, footwear, and textile products."

The Philippine government's plan to increase farm exports to the US and displace regional competitors with higher reciprocal tariffs was nonetheless welcomed by DBS.

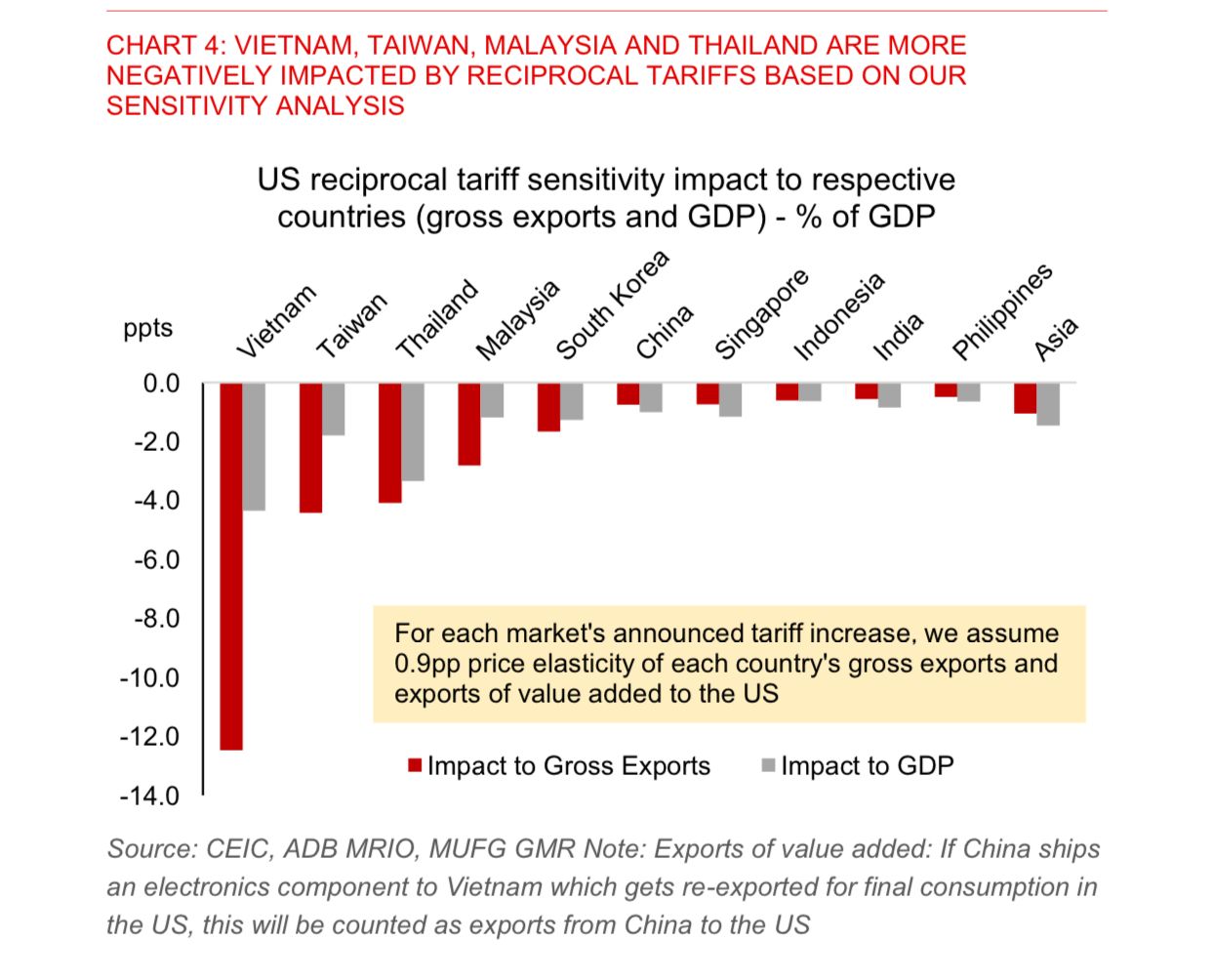

In a separate report also dated April 7, Japan's MUFG Bank Ltd. said that "India and the Philippines are relatively more insulated" from Trump's tariffs spree, unlike the "more vulnerable" Malaysia, Singapore, Taiwan, Thailand, and Vietnam.

"The impact to India and the Philippines' exports is smaller, at 0.5 to 0.6 percent of GDP," said MUFG Global Markets Research Asia head Lin Li, senior currency analysts Lloyd Chan and Michael Wan, and associate Khang Sek Lee.

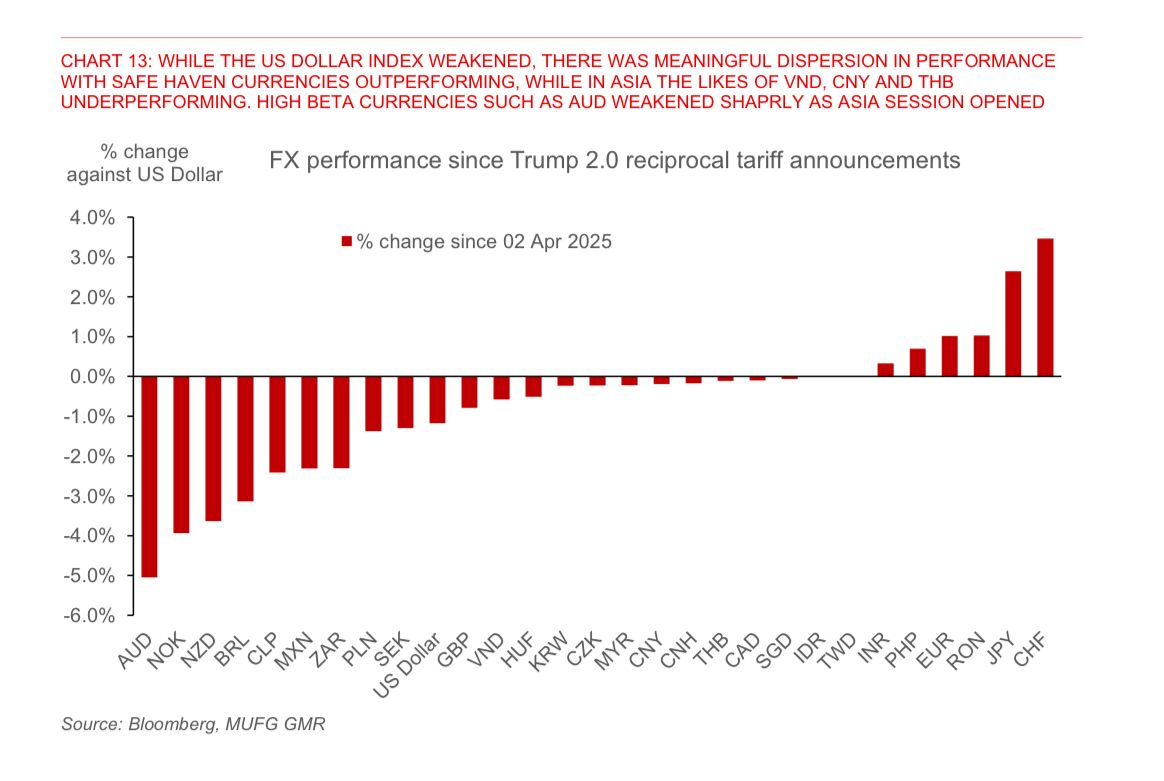

Similarly, the Indian and Philippine currencies would be shielded from major depreciation movements, MUFG said.

"We think that current levels of Asia's FX [foreign exchange] are not reflective of the tariffs impact yet. The Vietnamese dong, New Taiwan dollar, Thai baht, Singaporean dollar, and, to a smaller extent, Indonesian rupiah and South Korean won, look more vulnerable, while the Indian rupee and Philippine peso are more insulated," according to MUFG.

The Japanese banking giant also expects a BSP policy rate cut on April 10.