Despite limited US tariffs impact, Philippines' subpar growth to linger—DBS

Singapore-based DBS Bank Ltd. expects the Philippine economy to again grow below its target in 2025, despite benefiting from being outside the scope of United States (US) President Donald Trump's tariffs.

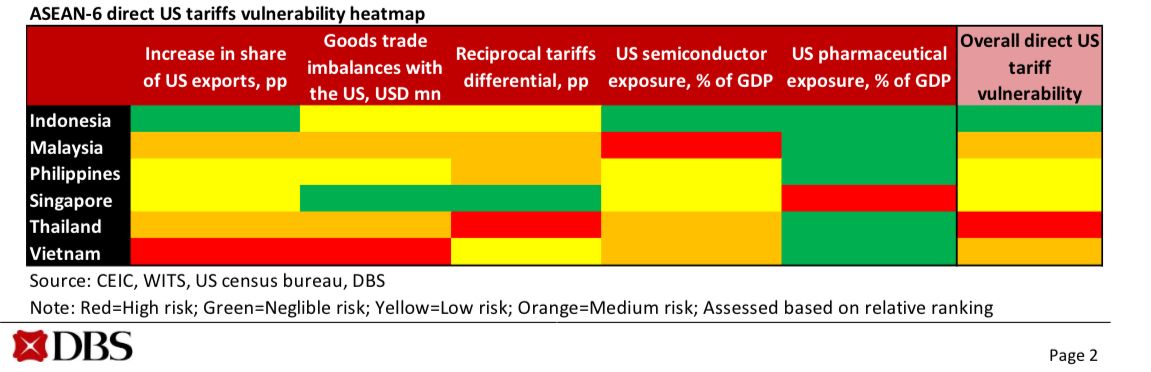

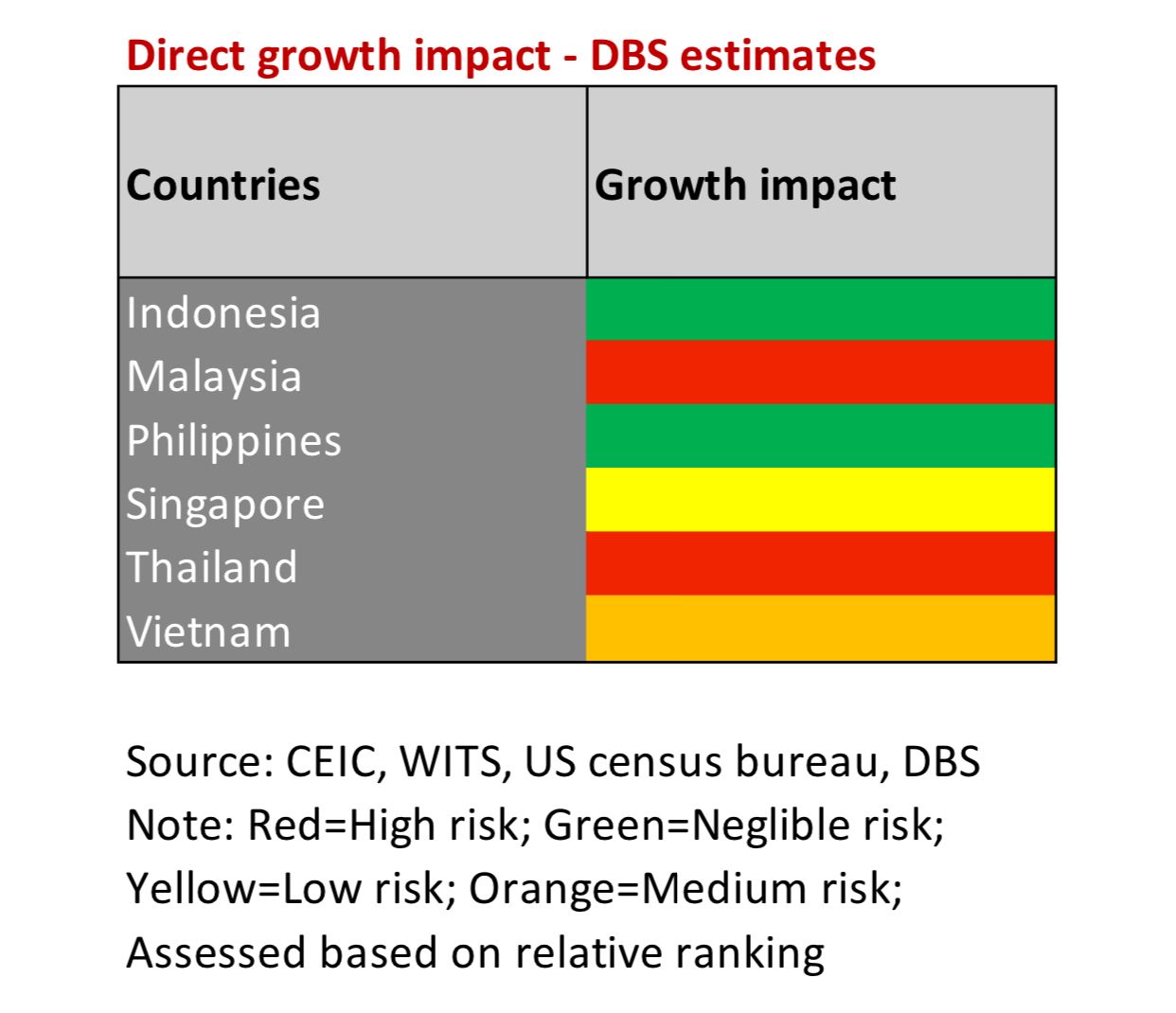

"Direct impact from US tariffs is likely to be limited, with the Philippines' contribution to value-add to US imports among the smallest versus ASEAN-6 countries and the size of the bilateral trade surplus moderate versus peers," DBS Group Research senior economists Chua Han Teng and Radhika Rao said in a March 26 report. ASEAN-6 refers to the Association of Southeast Asian Nations' six biggest economies, which, besides the Philippines, include Indonesia, Malaysia, Singapore, Thailand, and Vietnam.

"While the US is an important trade partner (accounting for 16.6 percent of total), exposure to targeted sectors like pharma and semiconductors, etc., is modest," DBS noted.

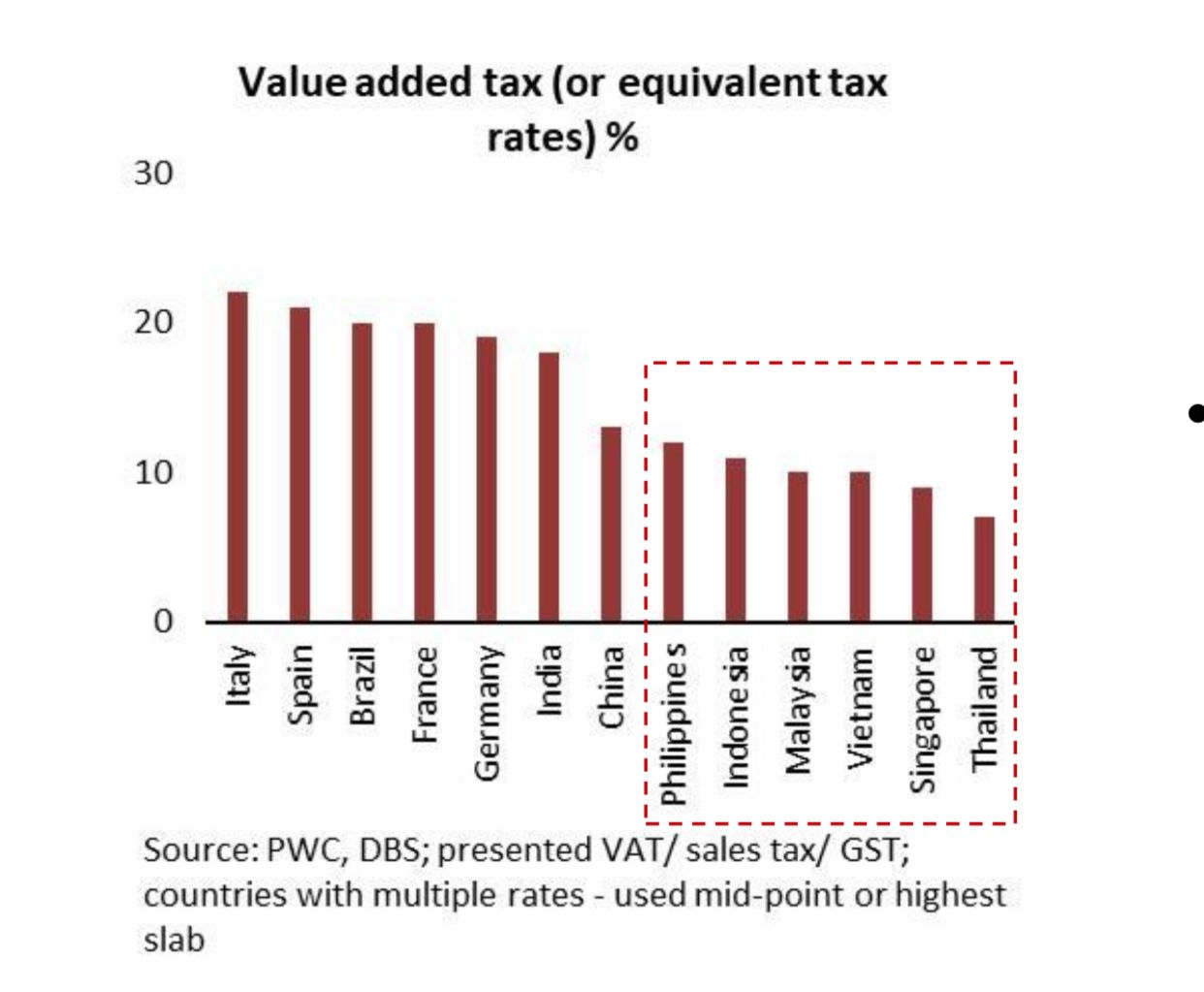

However, DBS said the Philippines' "high" 12-percent value-added tax (VAT) may make the country vulnerable to reciprocal action from Trump.

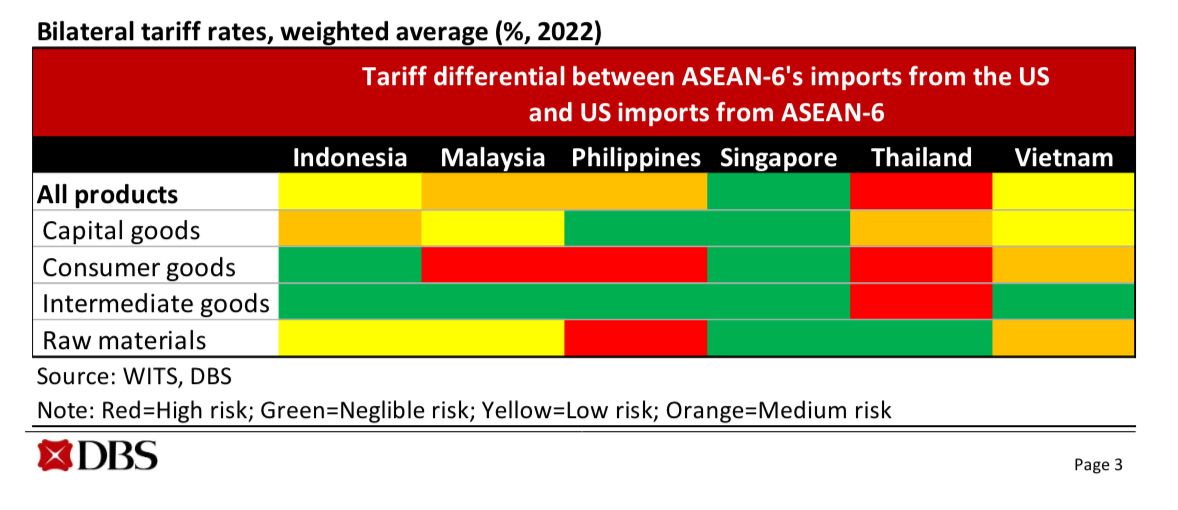

In particular, raw animal products and transportation goods imports from the Philippines may be at risk of higher tariffs.

The good news is that, in case the Philippines is slapped with reciprocal tariffs, "the scale is likely to be limited as the weighted average tariff rate on the US is small at 3.3 percent," DBS said.

The Singaporean bank deems Malaysia, Thailand, and Vietnam as "relatively more vulnerable" to Trump's tariffs, while the Philippines, Indonesia, and Singapore have "moderate spillover risk."

Across ASEAN-6, "while the direct impact could be via reciprocal tariff, the second derivative impact might be through slower growth in key trading partners, China and the US," DBS warned.

In terms of economic growth, DBS said that "the domestically oriented nature of the Indonesian and Philippine economies shields them, limiting the spillover impact to less than 0.3 percentage point (ppt)."

DBS projected the Philippine economy to expand by 5.8 percent this year, faster than last year's 5.6 percent, but slower than the targeted six to eight percent for 2025.

"Higher government spending, disbursements on infrastructure projects (ahead of the midterm elections in May) and the impact of rate easing are likely to compensate for subdued consumption," DBS explained.

"Politics is a watch factor," DBS added, referring to the escalating tensions between President Ferdinand Marcos Jr. and Vice President Sara Duterte-Carpio following the arrest of former President Rodrigo Duterte and his subsequent transfer to the International Criminal Court (ICC) for trial over the deadly drug war during the previous administration.

DBS also forecasts that the Bangko Sentral ng Pilipinas (BSP) could "stay data-dependent in the coming months, with an eye on tariff-driven uncertainty, while we retain our call for 50-basis point (bp) more cuts in the second half of the year."

The BSP is widely expected to resume its easing cycle and cut key interest rates on April 10 after unexpectedly pausing in February amid global economic uncertainties.

For DBS, "administrative measures including rice import tariffs and food security emergency, will keep a lid on inflation, while higher utilities and firmer wages are risks to the outlook."