Jollibee converts debt, raises $396 million for cost-effective refinancing

Jollibee Foods Corporation, one of the largest Asian food service companies, is raising $396 million from a U.S. dollar-denominated senior unsecured guaranteed notes offering as well as loans from local banks.

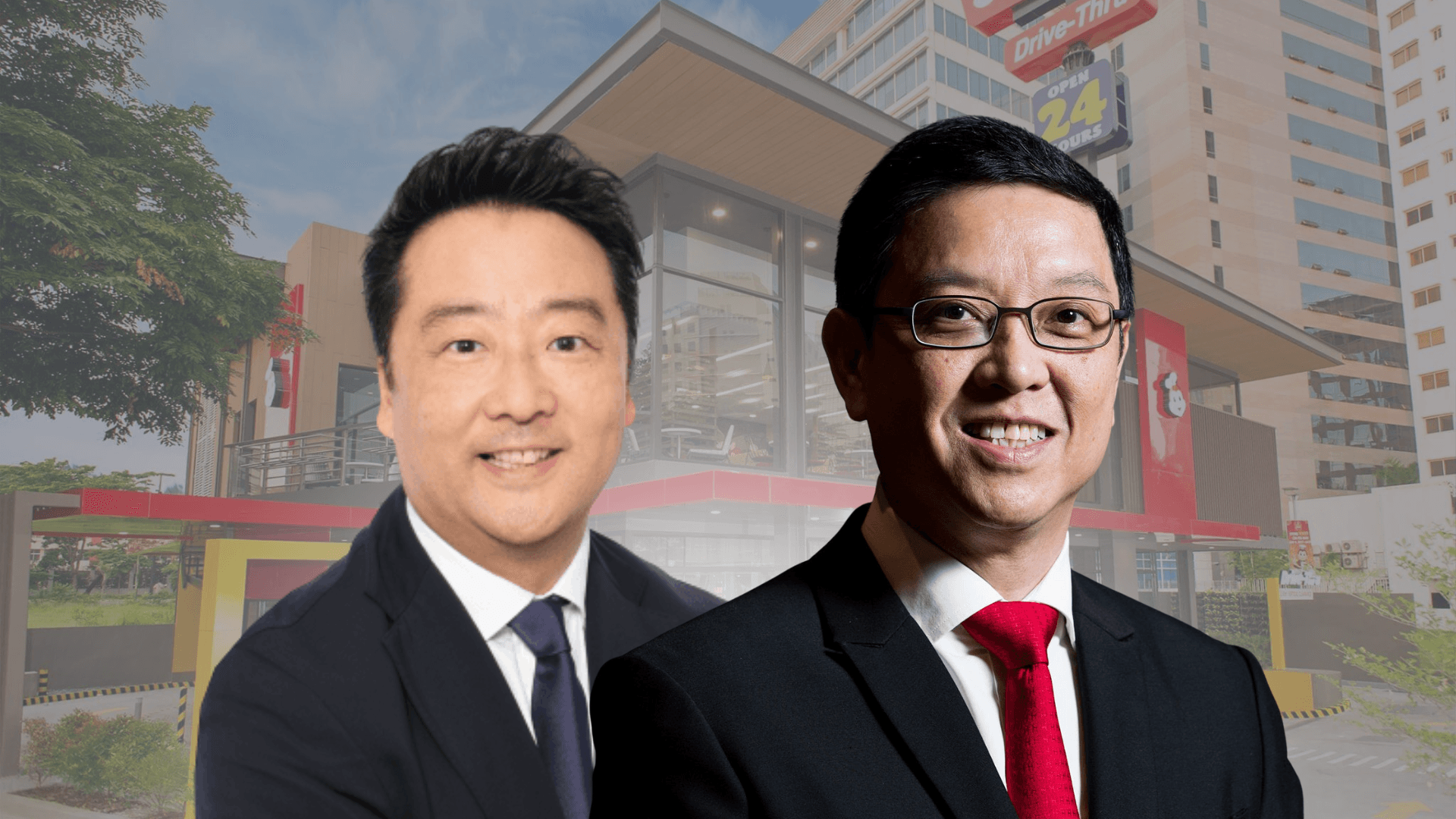

In an online media briefing, Jollibee Group Chief Financial and Risk Officer Richard Shin said they are refinancing bonds amounting to $396 million that are coming due.

“We have taken $96 million out of the $396 million...and converted this into peso because we’re really a peso company to a great extent. So we converted that into very favorable rate term loans onshore.

“We’re very fortunate because we have a lot of great banking partners who stepped up to finance us. So we got very attractive rates and we’re happy with that. We also want to contribute bnasck to the local financial system,” he noted.

Meanwhile, Shin said they will be raising a minimium of $300 million from its Regulation S only 5-year U.S. dollar-denominated senior unsecured guaranteed notes offering which will be priced today.

“The $300 million is almost like an unwritten, or maybe its written, minimum if you want to be listed in indexes,” he said adding that both local and international investors are interested “because we’re a very low credit risk company.”

Shin noted that, “if you go lower than that, it’s very hard to get attraction from some of the larger investors.”

The offering will allow Jollibee to convert this debt from perpetual to senior bonds because senior bonds are more cost-effective versus perpetual bonds, explained Shin who added that, “we want to do the best for our shareholders by getting the lowest cost of bonds.”

On March 24, 2025, Jollibee said wholly-owned subsidairy Jollibee Worldwide Pte. Ltd. has tapped J.P. Morgan Securities Asia Private Limited and Morgan Stanley Asia (Singapore) Pte. as the Joint Global Coordinators and Joint Bookrunners of the planned offering.

Jollibee has also nameded BPI Capital Corporation, The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch (HSBC) to be the Joint Lead Managers and Joint Bookrunners.

The four institutions has been mandated by Jollibee to arrange a series of fixed-income investor meetings commencing on March 24, 2025. The notes offering may follow, subject to market conditions.

“Proceeds from the contemplated offering are intended for the Issuer’s general corporate purposes and/or refinancing of its existing borrowings,” Jollibee said.

Jollibee is allotting ₱18 billion to ₱21 billion for capital expenditures this year as it reported a 17.7 percent growth in attributable net income to ₱10.3 billion last year from ₱8.77 billion in 2023 despite a drop in fourth quarter earnings.

Shin said the Jollibee Group plans to open 700-800 stores (gross) across brands and regions.

“We expect to deliver an eight percent to 12 percent growth in system wide sales in 2025, with four percent to six percent growth in same store sales and store network growth of four percent to eight percent. Operating profit growth will be in the range of 10 percent to 15 percent,” he added.

At the end of December 2024, the Jollibee Group’s store network increased by 41.8 percent to 9,766 compared to a year ago: Philippines (3,382) and International (6,384) - 580 in China, 369 in North America, 388 in EMEA, 850 with Highlands Coffee mainly in Vietnam, 1,232 with CBTL, 336 with Milksha and 2,629 with Compose Coffee in South Korea.