FROM THE MARGINS

Are we prepared to embrace the future that is arriving faster than we expected?

I am, of course, talking about Artificial Intelligence (AI), which is transforming industries across the world. I have been receiving a lot of invitations to attend seminars and conferences about how AI is revolutionizing the way we do things. Just last Feb. 27, I attended a highly engaging forum, “AI and Beyond,” organized by Unilab Foundation, Asian Institute of Management, Massachusetts Institute of Technology (MIT) and partners. I was awed by their insights about how AI is shaping the future of learning and work.

Digital transformation is reshaping many industries, including finance. All of us working in the microfinance sector need to accept that AI and technology will redefine our future.

Transformative force

While my microfinance network embarked on digital transformation years ago — well before digitalization became a buzzword — we recognize that “AI” still sounds intimidating or too advanced for the work that we do. Working with the poor and marginalized has made us aware of the sad reality that there are many challenges – systemic, infrastructural, geographical – that limit our outreach and services. At first glance, AI seems too sophisticated for microfinance. However, we have come to understand that it can be a powerful tool in advancing our mission of eradicating poverty.

The purpose of microfinance has always been to uplift the lives of Filipino families, especially those in vulnerable communities. We are the last-mile conduits that bring financial services to those who need it the most: the struggling nanays in the markets, the farmers in the fields, the small business owners in their stalls. Imagine if, through AI, we can serve them faster, better, and more efficiently!

As I told my colleagues, AI is not here to replace, but to help us. By leveraging AI technologies, the microfinance industry can reinvent itself, driving growth and sustainability to unprecedented levels.

AI for the mission

Our mission to eradicate poverty and promote financial inclusion can be revolutionized with the use of AI technologies. AI can help microfinance institutions (MFIs) improve operational efficiency, manage risks, and reduce operational costs while maintaining what makes us unique: our close relationship with our clients.

AI can be used to support our mission in many ways, including:

- Client data analysis - AI can help process data faster than ever before, helping us better understand our clients’ needs. This would enable us to design more responsive products and services, predict potential risks, and even intervene at the first sign of clients showing financial distress.

- Process automation - AI can automate repetitive tasks, allowing staff to focus on building relationships with existing clients as well as reaching out to more poor people and potential clients.

- Client support - AI-powered chatbots can provide 24/7 support, ensuring that clients are assisted even outside business hours.

- Credit scoring - like what MiDAS is trying to do, AI can analyze non-traditional data — such as mobile phone usage, spending behavior, or even social media patterns — to help in assessing clients with little or no formal credit history.

- Risk management - AI can enhance risk management systems, identifying fraud attempts or irregular transactions in real-time.

AI can enhance microfinance by automating processes, improving efficiency, and reducing resource requirements, allowing MFIs to focus on strategy, customer relations, and innovation. By enabling data-driven decision-making, AI can help MFIs identify growth opportunities and address challenges proactively. AI can also promote financial inclusion by helping MFIs serve more unbanked and underserved populations with innovative solutions, like mobile apps that provide access to savings, loans, insurance, and investments.

With these potential benefits, I encourage the leading microfinance industry associations, MCPI and APPEND, to work together in organizing a forum to explore how AI can revolutionize the industry.

People make the difference

AI can help MFIs remain competitive in a dynamic financial landscape. But technology alone will not transform the industry. It is our staff that will make the difference. Preparing microfinance workers for AI is as crucial as adopting the technology itself.

In our recent Executive Committee meeting, I am glad that my colleagues recognized that we need to invest not only in technologies but also in training and mindset shifts. AI is not just an IT project — it is an organizational transformation. Every staff member, from the field staff to our managers, must understand how AI works, how it will change their roles, and how they can use it to serve clients better.

It is crucial for my colleagues and friends in the microfinance industry to never lose our rai·son d'ê·tre: eradicate poverty. AI can help us reach and serve more people, but compassion, trust, and human connection will always be our foundation.

* * *

“All in all, AI and microfinance are bound to overlap more.” – Ajeet Kumar Singh

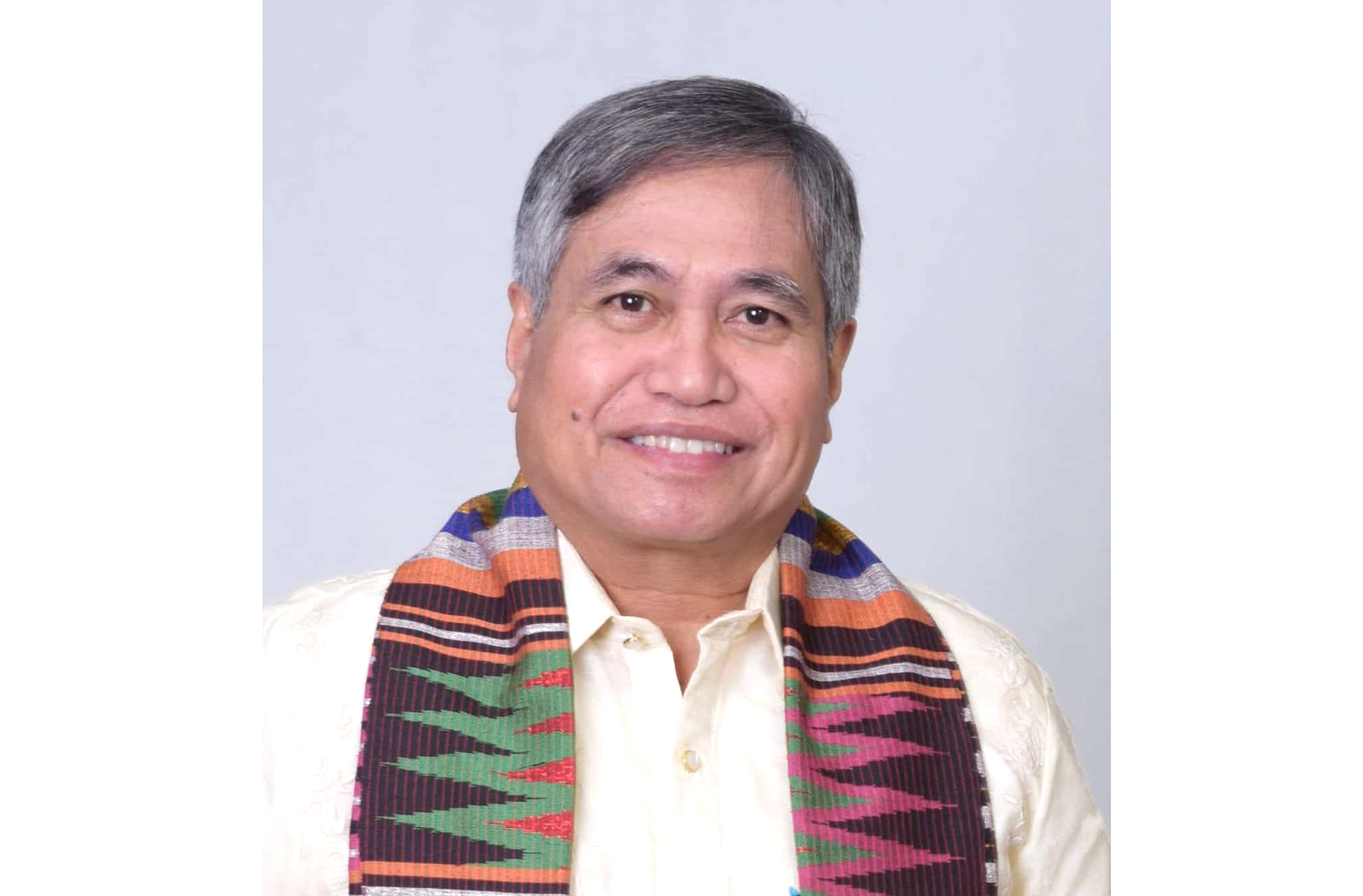

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)