FROM THE MARGINS

Last week, I wrote about how microentrepreneurship—fueled by microfinance — serves as an engine of job creation, economic progress and poverty eradication. We need to support micro, small, and medium enterprises (MSMEs) as they are the cornerstone of the Philippine economy. Micro and small enterprises (MSEs), especially, need help since keeping small businesses afloat is a continuous struggle.

The majority of clients of microfinance institutions (MFIs) are MSEs. We provide a gamut of products and services, including loans, savings, microinsurance, health, education, community development, among others, to address their needs —from lack of access to capital, to rising costs of materials, lack of business training, difficulty in registering their businesses, digitalization, among others. Their needs are varied and complex, so we keep on innovating and expanding to reach more of the unserved and underserved. I am happy to share below some of our clients’ stories, which illustrate the power of microfinance in transforming lives and MSEs.

Fulfilling dreams

The story of Ronelito and Jovelyn Talorete from Negros Oriental is of perseverance and hard work. From humble beginnings as friends introduced through a mutual connection, the now-married couple has transformed their lives, starting a business that is also helping their community.

Their road to success was not easy. They worked tirelessly for years, performing various jobs to make ends meet. From working as a housekeeper, food vendor, and motorcycle taxi driver—they persevered through financial struggles to build a thriving sand and gravel business.

The couple struggled to secure capital from banks and other financial institutions, making their dream seem out of reach. Fortunately, a microfinance NGO recognized their potential and provided a small loan to jumpstart their venture. With financial backing, hard work, and determination, their business grew—creating jobs, supporting their family, and helping relatives with their education.

“Microfinance gave us the opportunity that banks wouldn’t,” shared Jovelyn. “With small capital, effort, and financial planning, our determination paid off,” Ronelito added.

Their story proves the power of microfinance in empowering small entrepreneurs and making financial services accessible to those traditionally overlooked by banks and formal credit institutions.

Nurturing health and hope

At 18, Buena Bariring’s dreams were shattered when a medical exam revealed she had a chronic medical condition that cost her a job and exposed her to stigma. Finding solace in an online support group, she met Rowena Jordan, who later became her friend and business partner.

In 2013, drawing on a skill she learned from her mother, Buena started a small business. She approached a microfinance-oriented thrift bank, securing a ₱3,000 loan to start a weaving business using dried water lilies. By 2014, Rowena joined her, handling designs while Buena crafted the products. As their business grew, they both became microfinance clients of the thrift bank, solidifying their financial foundation and partnership.

Despite setbacks from the 2020 pandemic, including losses and illness, they persevered. Today, with continued microfinance support, they employ several workers. Their products have become popular among Overseas Filipino Workers (OFWs), who buy them as unique souvenirs to bring abroad.

“I once searched for opportunities—now, I create them,” Buena shared. Her story is proof that resilience, paired with accessible financial support, can turn adversity into success.

Enhancing financial resilience

Microfinance helps strengthen people’s financial resilience by providing accessible financial services to underserved communities. The latest data (fourth quarter, 2023) from the Financial Inclusion Dashboard of the Bangko Sentral ng Pilipinas show that 135 banks offer microfinance services, serving 1.99 million borrowers with loans totaling ₱31.99 billion. Outside the banking system, microfinance NGOs serve 6.8 million clients, extending loans amounting to ₱80.4 billion, while cooperatives serve 9.9 million members, with outstanding loans worth ₱366.6 billion. These efforts enable individuals to manage financial emergencies, invest in income-generating activities, and improve their overall financial well-being.

A recent study by Dr. Jan Carlo (JC) Punongbayan, Solomon Sarne, Reycel Hyacenth Bendaña, Jessica Marie Robredo, and Nicole Anne Cobarrubias documents the impact of microfinance in enhancing the consumption smoothing and financial resilience of low-income Filipino households. The survey, which analyzed 1,900 households nationwide, found that 56.6 percent of respondents who were aware of microfinance availed of its services, with loans primarily used for business expansion, education, and emergencies. Microfinance significantly improved consumption stability for 88.4 percent of users and enhanced resilience for 65.4 percent, helping households manage economic shocks such as the Covid-19 pandemic, inflation, and natural disasters.

Amid worsening poverty, MFIs provide life-saving opportunities to poor households and MSEs. As the stories of Ronelito, Jovelyn, Buena and Rowena have shown, their microfinance loans provided not just capital for their small business, but stepping stones towards the fulfillment of their dreams.

* * *

“If we want to truly transform the Philippine economy and society, we must not only take care of our MSMEs, but also make sure that they are able to grow, flourish, and compete globally.” –Pres. Ferdinand Marcos, Jr.

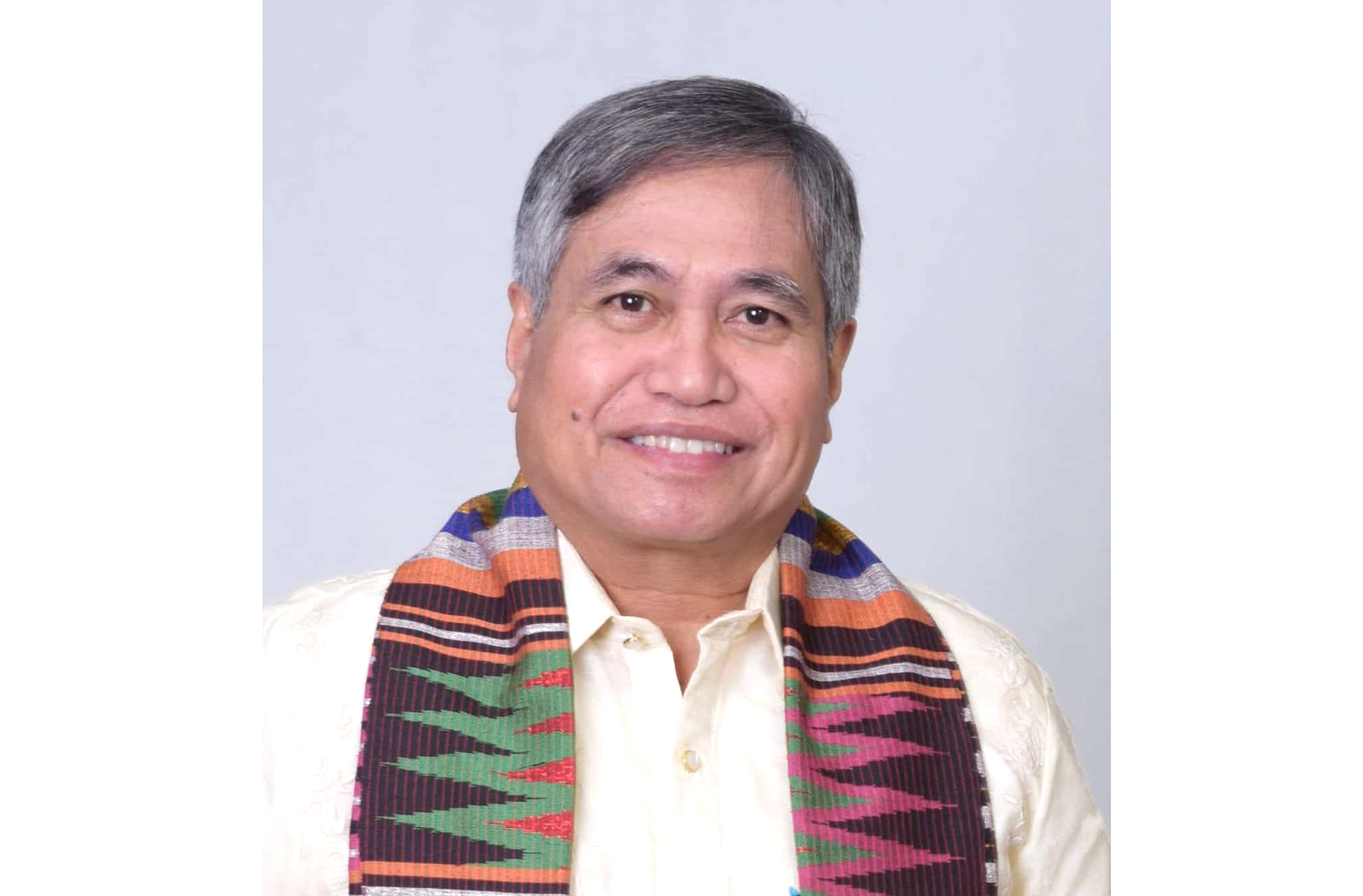

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)