Metro Manila's real estate puzzle: Oversupply, opportunity, and recovery

Here's what you need to know about the state of Metro Manila and beyond regarding office spaces, residential properties, data centers, tourism, and capital markets

Metro Manila is grappling with an oversupply of condominiums and office spaces, but what caused this imbalance? Understanding the factors behind the surplus provides a clearer picture of the challenges and opportunities in today’s real estate market.

Why is there an oversupply?

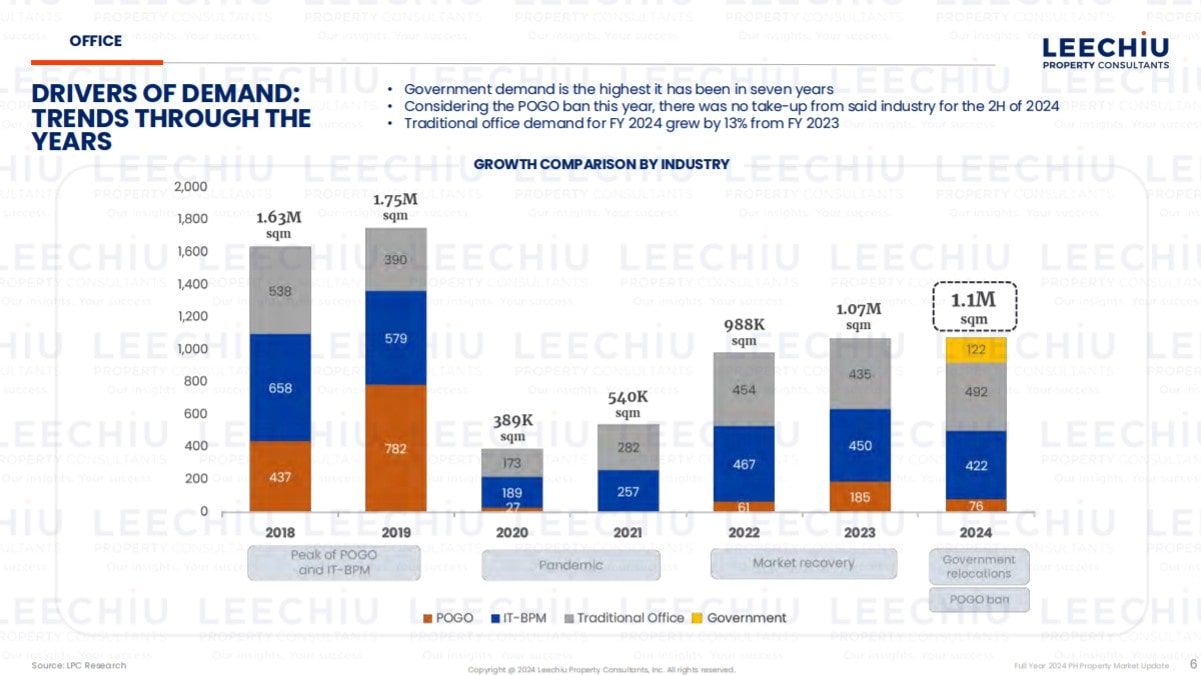

The property boom from 2017 to 2019 fueled rapid development, driven by urbanization, rising incomes, and a thriving Business Process Outsourcing (BPO) sector. This period saw unprecedented demand for homes and office spaces, prompting developers to build aggressively.

However, the COVID-19 pandemic in 2020 disrupted this momentum. The rise of work-from-home arrangements significantly reduced the need for office spaces. Similarly, many mid-market condominiums priced between ₱3 million and ₱20 million were left unsold as economic uncertainties weighed on buyers.

Adding to the strain, the ban on Philippine Offshore Gaming Operators (POGOs) removed a major player from the market. POGOs once occupied 10 percent of Metro Manila’s leasable office space—1.3 million square meters. Their departure, due to illegal activities, left landlords struggling to fill vacancies. The ripple effect extended to residential markets, where areas reliant on POGO workers saw tenant losses and increased financial pressure on landlords.

These combined factors have resulted in Metro Manila having a staggering 29 months’ worth of condominium inventory, the highest since the pandemic, according to Leechiu Property Consultants’ (LPC) 2024 market report. Across 510 actively selling buildings there are 67,600 units available, with Quezon City leading at 18,500 units, followed by Ortigas with 13,500, and the Bay Area in Pasay with 10,500.

How are developers responding?

Developers, acknowledging the excessively abundant supply, have significantly slowed down new project launches. By November 2024, new launches were approximately half of 2023’s total, with 13,226 units introduced compared to the previous year.

To attract buyers, developers are re-strategizing their offerings. With inflation easing and the Bangko Sentral ng Pilipinas (BSP) starting to lower interest rates—including a 25-basis-point cut in late 2024—they are offering competitive payment terms and value-added features. According to the LPC report, these adjustments present an “opportunity for buyers to invest as developers repackage remaining inventory.”

Shifting focus beyond Metro Manila

As Metro Manila deals with oversupply, developers, and investors are increasingly looking to emerging markets in Visayas and Mindanao. Iloilo, Bacolod, and Bohol are gaining traction, with demand outpacing supply in these regions.

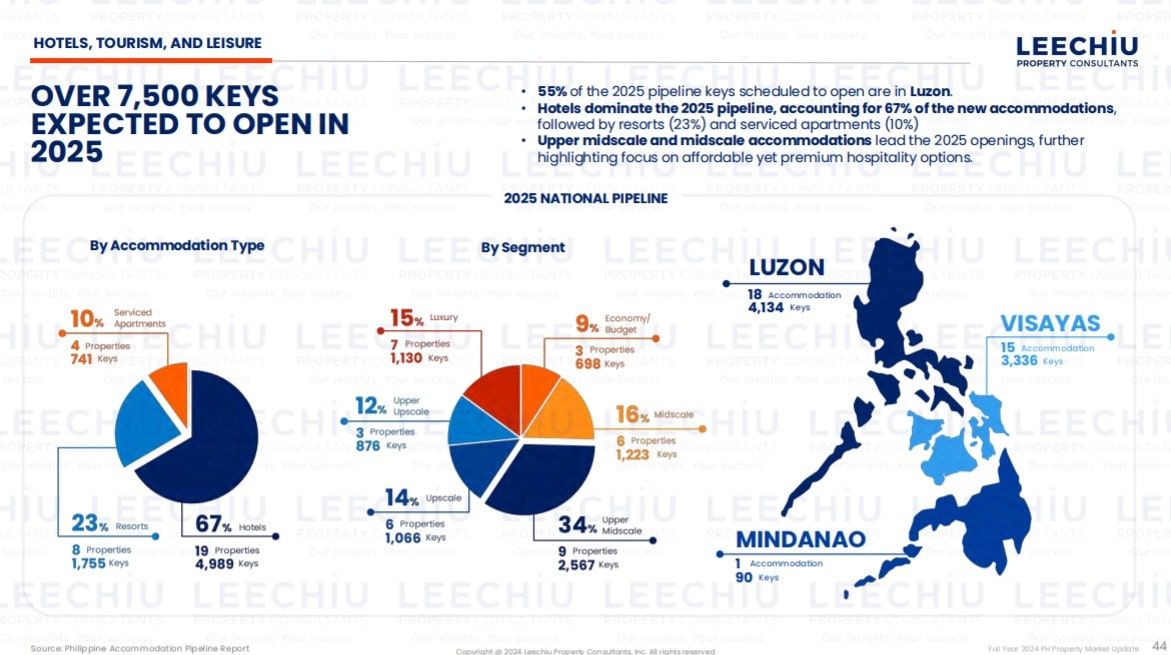

Metro Manila is still expected to lead 2025 accommodation openings, contributing 38 percent of the total 7,500 keys. However, in the Visayas, Region VII (Central Visayas) leads with 2,354 keys, including 936 in Panglao. Luzon remains dominant overall, with hotels comprising 67 percent of the 2025 pipeline, followed by resorts (23 percent) and serviced apartments (10 percent). Upper-midscale and midscale accommodations are the primary focus, reflecting demand for affordable yet premium options.

Opportunities amid challenges

Despite current challenges, the Philippine real estate sector shows promise for recovery. With developers adapting strategies, interest rates easing, and regional markets growing, the industry is poised to find balance in the coming years. For buyers, this period offers a unique chance to invest under favorable conditions in a market ripe for correction.