Cash transactions persist in country's booming e-commerce market

The Philippines' e-commerce market is poised for sustained growth over the next five years, driven by Filipinos' increasing preference for online shopping, despite challenges such as high unbanked rates and limited financial literacy.

GlobalData forecasts that the Philippines' e-commerce market will reach P2.6 trillion by 2028, growing at a “healthy pace” of 16.3 percent annually, from P1.1 trillion last year.

However, the average projected yearly growth rate is slower compared to the 27.8 percent expansion recorded in 2023.

“The e-commerce market is expected to continue the strong momentum and is estimated to grow by 23.3 percent to reach P1.4 trillion ($25.4 billion) in 2024,” GlobalData said in a statement.

According to GlobalData’s 2023 Financial Services Consumer Survey, 88.2 percent of Filipino consumers reported shopping online in the past six months, while only seven percent indicated that they had never shopped online.

Kartik Challa, Senior Banking and Payments Analyst at GlobalData, noted that the growth of the e-commerce market is driven by rising internet penetration, improving logistics, an increase in the number of middle-income families, and growing confidence in online payments.

“With a preference for online shopping due to its ease and time-saving benefits, Filipinos are embracing digital platforms, making e-commerce an integral part of their shopping experience,” Challa said.

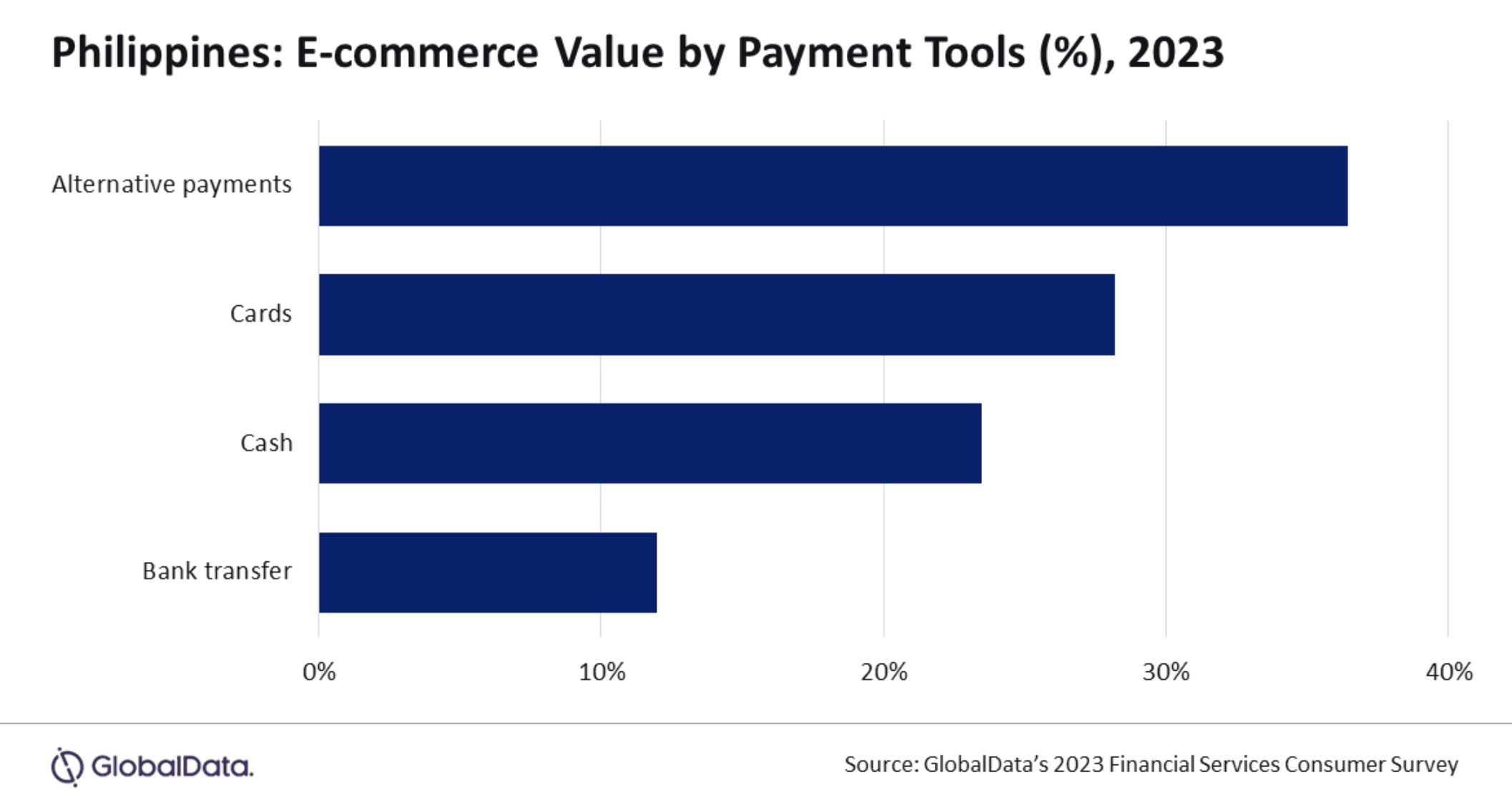

However, he also pointed out that despite the rise in electronic payments, over 23.5 percent of e-commerce purchases in the country are still made in cash.

“This highlights the traditional preference for cash among Filipino consumers due to its high unbanked population and limited financial awareness especially among the rural population,” he said.

Meanwhile, Generation Z and millennials are embracing new payment technologies.

GlobalData reported that alternative payment solutions are increasingly being utilized for online purchases by these age groups, collectively accounting for a 36.4 percent market share. Popular brands in this space include GCash, Maya, PayPal, and Dragonpay.

Consumers appreciate these alternative payment methods for their simplicity and ease of use, GlobalData said.

Supporting the growth of alternative payments are new payment models, such as “buy now, pay later,” which allow consumers to split their total purchase amounts into installments. Several providers, including Atome, BillEase, Akulaku, and Tendo, are offering this service in the Philippines.