FROM THE MARGINS

There is nothing more inspiring than stories of microfinance women-clients transforming their lives for the better. Narratives of “nanays” starting small businesses from microfinance loans, improving their families’ well-being and contributing to their communities’ economic growth demonstrate the ripple effect of microfinance. This is why I was so glad to have been a part of the 30th anniversary celebration of the SEDP-Simbag sa Pag-Asenso, Inc. last June.

SEDP is a pioneering microfinance institution serving more than 89,000 clients in Bicol and Northern Samar. I thank Fr. Rex Paul Arjona, their president/CEO, for inviting me as the keynote speaker to their Leaders’ Conference, which was participated in by more than 1,000 center leaders, mostly women micro-entrepreneurs. It was a pleasure to meet them, as well as the Most Rev. Joel Baylon, Bishop of Legazpi and SEDP’s board chairman, with other Board members, like Fr. Jovic Lobrigo, rural banker Miel Moraleda, and other officers, staff and guests.

Inspiring Nanays

I would like to congratulate SEDP’s “30 Inspiring Nanays.” Their stories encapsulate the hopes, struggles and triumphs of millions of microfinance clients. Let me cite the top inspiring awardees:

- Noemi Belgrado from Baao, Camarines Sur borrowed funds to buy farm implements and raise hogs. Later, she bought a mortgaged rice land, a truck and a corn sheller, which she rented out to other farmers. She helps the community by trading farmers’ produce and selling cheap fertilizers and pesticides.

- Vilma Bernales, also from Baao, ventured into vegetable vending, sari-sari store, peanut butter and coco jam production, auto repair shop, and hollow block production. She has become an active leader of their Barangay Pastoral Council.

- Marites Miranda from Bacacay, Albay used loans for microenterprises, like buying-and-selling native products, sari-sari store, pedicab operation, and videoke rental. She is active in school and church activities in their barangay.

- Paz Guray from Bulan, Sorsogon borrowed funds for hog-raising and food vending. She later bought mortgaged farms and planted coconut and rice. Her seven children are all college graduates; one even became a priest. She and her husband are active in church activities. They distribute rice packs to impoverished families during harvest time.

- Jeaneth Rellora from Castilla, Sorsogon started a vegetable vending business and later ventured into ginger tea production. SEDP helped her in developing and registering her cassava and taro chips, which are now sold at supermarkets and malls.

Working together

I was asked to give a talk about working together for inclusive, sustainable and people-centered development. I started with positive news about our economy: GDP growth expanded to 5.7 percent in the first quarter of 2024, while unemployment rate fell to 3.9 percent. Our foreign direct investment is rising, with 29.3 percent increase year-on-year, reaching US$1.4 billion in February 2024. These are all good signs.

Still, we need to look into how marginalized groups are coping with inflation and climate change, which negatively impact economic growth. While our poverty rate is declining (22.4 percent in the first quarter of 2023), this still translates to 25.24 million poor Filipinos unable to meet their basic food needs. Malnutrition is a perennial concern. According to UNICEF, as of 2023, malnutrition kills 95 Filipino children daily and 27 out of 1,000 children do not get past their fifth year. Poverty is also taking its toll on our children’s education. Problems go beyond low enrolment figures and drop-out rates. Our students’ dismal performance in the Programme for International Student Assessment is worrying. Clearly, hungry children do not make good students.

How can the microfinance industry help the poor weather these challenges?

The answer, to me, is simple: to do more, to reach more. We must promote financial inclusion, but at the same time, we must also expand our non-financial products and services. MFIs could make a lot of difference by –

- Increasing our outreach toward the unserved and underserved: Indigenous peoples, Muslim communities, young entrepreneurs, and physically-challenged individuals;

- Offering diversified financial products like agricultural loans and value chain financing, small-and-medium-enterprise loans, gadget loans, climate change support loans, and others; and

- Offering diversified microinsurance products like disaster insurance, business interruption insurance, health insurance, and income support insurance.

The transformative power of microfinance could be maximized by investing more on education and health. Let us offer scholarship programs, support day care centers, and explore joint ventures for senior citizen care facilities, hospitals, clinics, pharmacies and other health-related projects.

We also need to deliver services more efficiently through digitalization, offer alternative delivery channels and strengthen our core banking systems to protect against cyberattacks. Supporting our clients’ journey toward digital marketing is also a must, as amply demonstrated by various MFI innovations, like ASKI’s marketing thru its coop, K-Coop’s Project Karinderya, and SEDP’s Online Marketing and Pasalubong Center.

I know these recommendations are challenging, but doable, if the industry can unite as one.

* * *

“Microfinance is not about giving people fish; it’s about teaching them how to fish.” – Esther Duflo

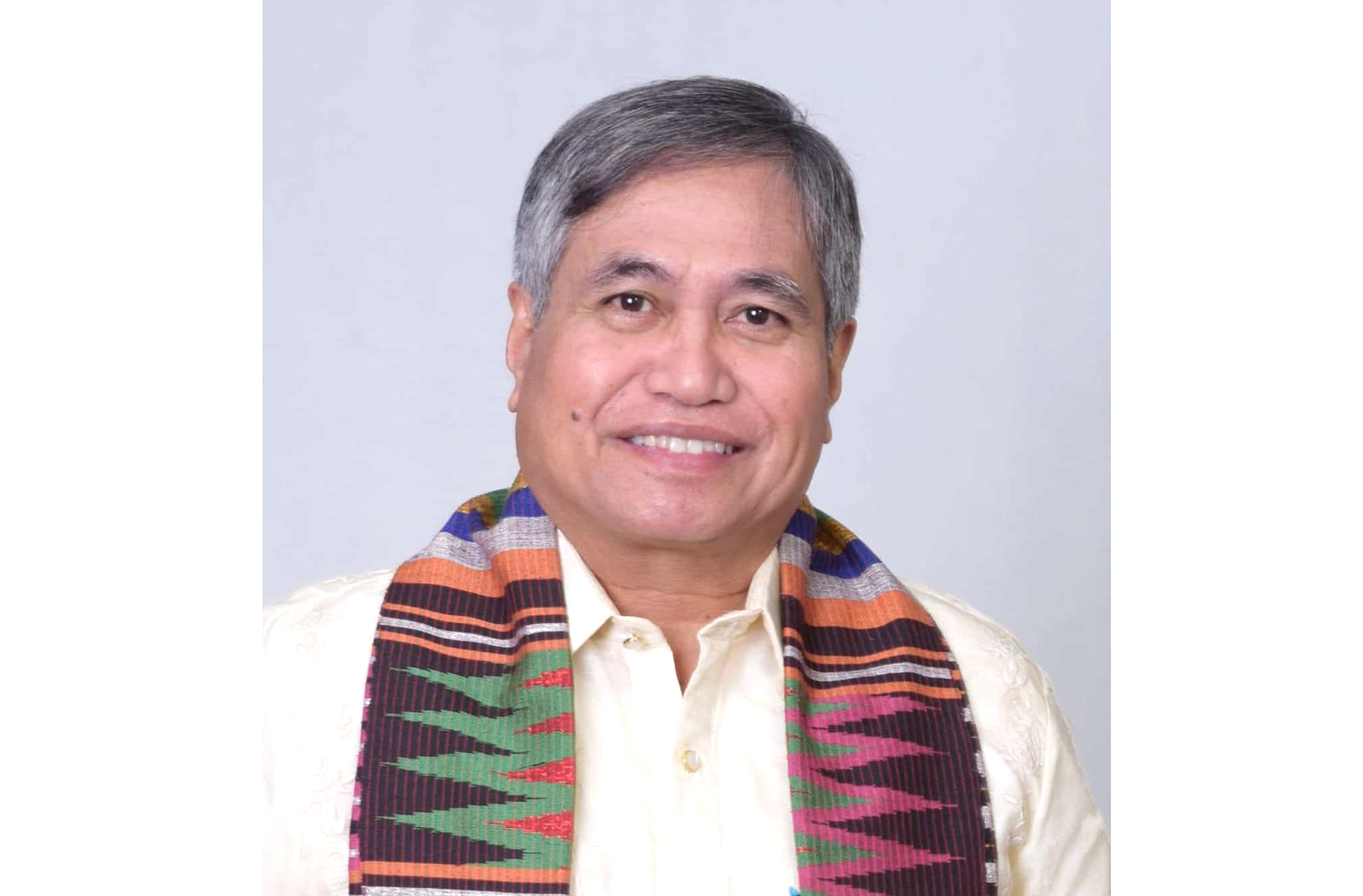

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI).)