GoTyme Bank, CICC sign MoU to step up collaboration to fight financial fraud

The MoU acts as a warning for cybercriminals as coordinated efforts build up to putting them to justice

By MB Technews

At A Glance

- GoTyme Bank and the Cybercrime Investigation and Coordinating Center (CICC) signed a memorandum of understanding (MoU) to strengthen real-time safeguards against cybercrime.

- The partnership aims to enhance cybercrime awareness and education as part of Scam Watch Pilipinas.

- GoTyme Bank expects to reach 5 million customers by the end of the year and will continue to invest in advanced cybersecurity systems.

- The collaboration highlights a "Whole-of-Society" approach to fighting cybercrime, emphasizing public-private partnerships.

GoTyme Bank, a joint venture between the Gokongwei group of companies and the multi-country digital banking group Tyme, and the Cybercrime Investigation and Coordinating Center (CICC) vowed to step up their collaboration to strengthen real-time safeguards against cybercrime with the expected surge in digital bank customers.

The CICC is an attached agency of the Department of Information and Communications Technology (DICT). It was created by Republic Act 10175, the Cybercrime Prevention Act of 2012, and is the country’s lead agency in the prevention and suppression of cybercrime.

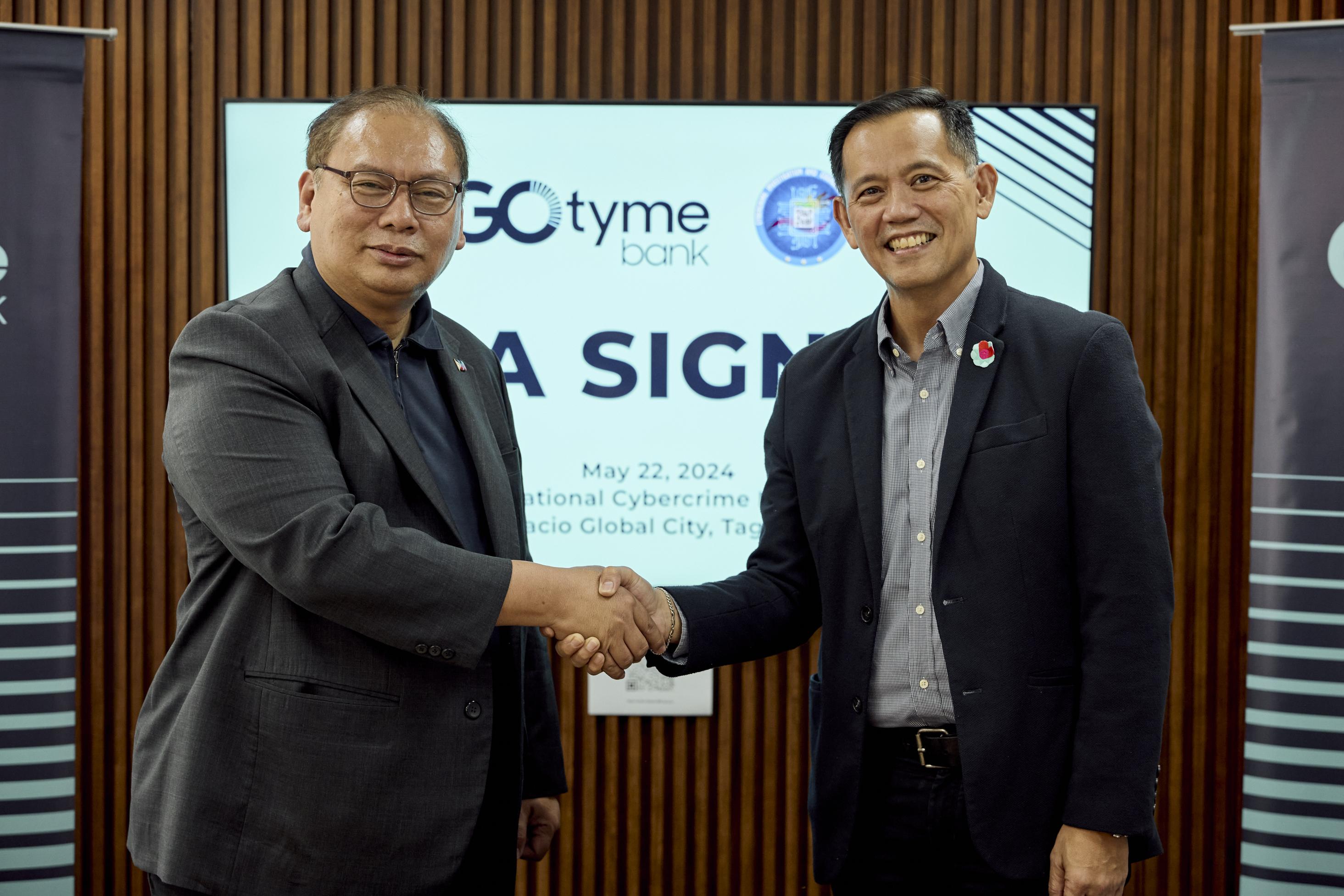

GoTyme Bank Co-Chief Executive Officer Albert Tinio and CICC Executive Director Alexander K. Ramos signed a memorandum of understanding (MoU) on May 22, 2024, at the National Cybercrime Hub in Bonifacio Global City in Taguig City.

GoTyme has been closely collaborating with CICC on cybercrime awareness and education as part of Scam Watch Pilipinas.

Tinio said, “The MoU is a big step and acts as a warning for those committing these crimes as coordinated efforts ramp up to bring these people to justice.”

“To get the edge on attacks, cybersecurity professionals and governments should embrace data and public-private partnerships such as this,” he added.

Ramos welcomed the partnership with the private sector as part of the “Whole-of-Society” approach he introduced in fighting cybercrime. “Cyber security is now more essential to our future than ever before. It’s the line of defense for virtually everything we rely on today: financial services, healthcare, travel, personal information, and identity. In the long haul, we are out to fortify and improve the country’s cyber resilience,” he said.

GoTyme will continue to invest in the best systems and technologies for cybersecurity and fraud management as it expects its customers to reach 5 million by the end of the year.

“We remain committed to working closely with CICC and other government agencies because cross-sector collaboration is a game changer that helps keep cyber threats in check,” Tinio underscored.

GoTyme is one of the fastest-growing banks in the country, having reached 3 million customers in April 2024—only 18 months since the start of commercial operations in October 2022.

In a GoTyme-commissioned brand health survey by Kantar, the bank scored high in terms of perceptions of safety and security. Driving this public perception of trust are GoTyme’s use of the latest technologies, its innovation-driven approach, its safety and security, its accessibility, and its value for customer privacy.