SMC leads Philippine firms in Fortune's 'Southeast Asia 500' ranking

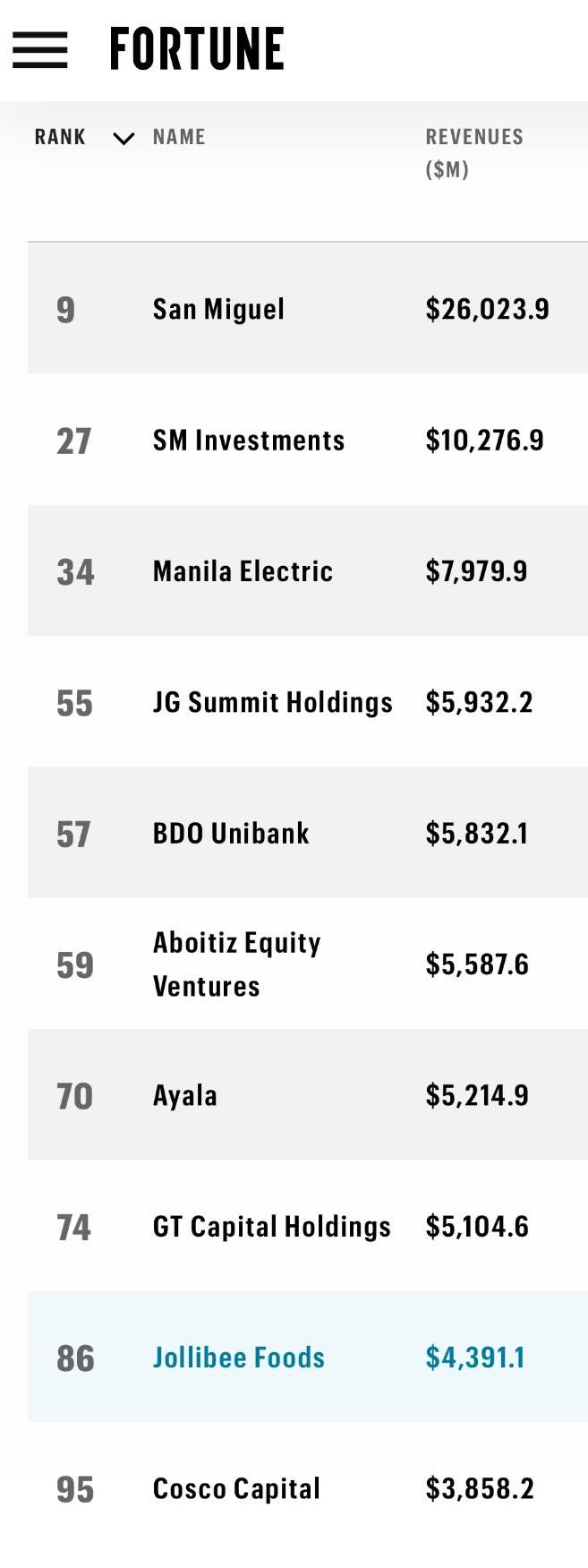

Diversified conglomerate San Miguel Corporation emerged as the leader among 38 Philippine firms in terms of revenues and as the only one among the top 10 in the first Fortune Southeast Asia 500 list.

“The Fortune Southeast Asia 500 debuts right as global business is starting to pay closer attention to the region. Southeast Asian economies are benefiting from supply chain diversification as rapid domestic development builds the next wave of global middle-class consumers,” Fortune Magazine said.

It noted that “Our new ranking reflects the rise and fall of energy markets, multinational supply chains, and tourism in some of the world’s most dynamic economies.”

The top 10 Philippine firms in the list are SMC (#9), SM Investments Corporation (#27), Manile Electric Company (#34), JG Summit Holdings Inc. (#55), BDO Unibank (#57), Aboitiz Equity Ventures (#59), Ayala Corporation (#70), GT Capital Holdings (#74), Jollibee Foods Corporation (#86), and Cosco Capital (#95).

Fortune ranked the companies by revenue for the 2023 fiscal year. These companies are from seven Southeast Asian nations, including the Philippines, Indonesia, Thailand, Malaysia, Singapore, Vietnam, and Cambodia.

The inaugural Fortune Southeast Asia 500 list, the magazine’s first-ever ranking of the largest companies in this part of the world, reflects a dynamic and fast-changing region—one that boasts a gross domestic product of $4 trillion and one whose core economies are growing notably faster than those of Europe or the U.S.

Southeast Asia is also taking on far greater significance in the global economy. In the wake of the COVID pandemic, a host of Global 500 multinationals have shifted more of their supply chains to Southeast Asian nations. Foreign direct investment in the region is soaring.

And, with a young and growing population of 680 million, low inflation, and stable exchange rates, Southeast Asia is emerging as an attractive market in its own right.

“The Fortune Southeast Asia 500 reflects a dynamic and fast-changing region — one whose core economies are growing notably faster than those of Europe or the U.S. This is partly due to Southeast Asia taking on far greater significance in the global economy, not least because a host of Global 500 multinationals have shifted more of their supply chains to Southeast Asian nations,” said Clay Chandler, Executive Editor, Asia at Fortune.

“We are thrilled to introduce the Southeast Asia 500 to our international readers as we build on the 70-year history of publishing the Fortune 500. With this new list, we turn the spotlight on the impressive growth story of Southeast Asia and the largest companies driving this diverse region and its economies,” said Khoon-Fong Ang, Fortune’s Chief of Operations, Asia.

A defining feature of the Southeast Asia 500 is its domination by a handful of giant firms with far-flung global operations.

However, greater exposure to overseas markets may explain why Southeast Asia’s largest companies saw their revenue shrink last year even as regional economies grew.

In total, companies on the Fortune Southeast Asia 500 took in $1.79 trillion in revenue in 2023, a drop of $45 billion, or 2.5 percent, from the previous year. Earnings shrank to nearly $130 billion, down $13.9 billion, or 9.6 percent, from 2022.

The declines contrasted with the relative resilience of the region’s six core economies. Those nations—Indonesia, Thailand, Malaysia, Singapore, Vietnam, and the Philippines—all grew their GDP last year, accelerating at a collective pace of 4.2 percent, down from 5.5 percent in 2022, according to the International Monetary Fund.