At A Glance

- "For the Metro Manila retail sector, innovation is the name of the game. We see aggressive transformation of retail spaces as operators scramble to attract new foreign retailers and sustain footfall. Expect more refreshed leasable spaces in the years to come. Retailers are also likely to be more strategic especially with transit-oriented retail becoming the norm," said Colliers Philippines Director for Research Joey Roi Bondoc.

Amid continuing high vacancy rate and lukewarm overall real estate industry in the country, a buoyant retail sector is expected to provide the much-needed breather with more landlords aggressively undertaking renovations along with more mall completion as foreign brands are testing the local waters.

The Colliers’ Q1 2024 Philippine Property Market Briefing on May 2 showed that landlords are aggressively renovating and upgrading their leasable retail spaces to attract more consumers. Retail properties refer to spaces used exclusively to market and sell consumer goods and services. Retail stores include everything from supermarkets, dry-cleaners, cafes, florists, pharmacies, bike shops, fashion stores and so on. They range from shopping centers, individual stores and pop-up shops to ‘large format’ stores.

“For the Metro Manila retail sector, innovation is the name of the game. We see aggressive transformation of retail spaces as operators scramble to attract new foreign retailers and sustain footfall. Expect more refreshed leasable spaces in the years to come. Retailers are also likely to be more strategic especially with transit-oriented retail becoming the norm,” said Colliers Philippines Director for Research Joey Roi Bondoc.

IN-TRANSIT RETAIL

Philippine and foreign brands continue to occupy mall space with some retailers even making a comeback to the Manila retail landscape by locating both in stand-alone malls and transit-oriented shopping centers. Pockets of renovation and total mall redevelopment are visible all over Metro Manila as landlords and retailers aim to sustain footfall and consumer spending despite dissipating impacts of revenge spending, the real estate property management experts said.

Colliers believes that more foreign and local retail tenants are likely to gravitate towards transit-oriented retail spaces for the remainder of 2024.

In 2023, Colliers observed that some local and foreign brands transferred from stand-alone malls in Metro Manila to transit-oriented retail spaces like One Ayala. The latter’s retail component has an occupancy of about 60 percent. It noted that as of March 2023, One Ayala features a myriad of retailers from personal accessory, fast fashion, and food and beverage segments. In our view, One Ayala’s retail component greatly benefits from the presence of its 89,000 sq meter (957,600 sq feet) office space, with outsourcing employees as among the shops’ immediate market.

In its view, One Ayala’s retail component greatly benefits from the presence of its 89,000 sq meter (957,600 sq feet) office space, with outsourcing employees as among the shops’ immediate market. Colliers believes that more foreign and local retail tenants are likely to gravitate towards transit-oriented retail spaces for the remainder of 2024.

These formats will also become more popular moving forward especially with the planned completion of major public projects in Metro Manila and other major cities outside the capital region from 2027 to 2029 including airports, railways, bus rapid transit systems, and the Metro Manila subway.

From Q4 2023 to Q1 2024, Colliers also recorded the completion of regional and super-regional malls across the capital region. From 2024 to 2026, the Bay Area and Quezon City will contribute to new retail space completion.

DEMAND and SUPPLY

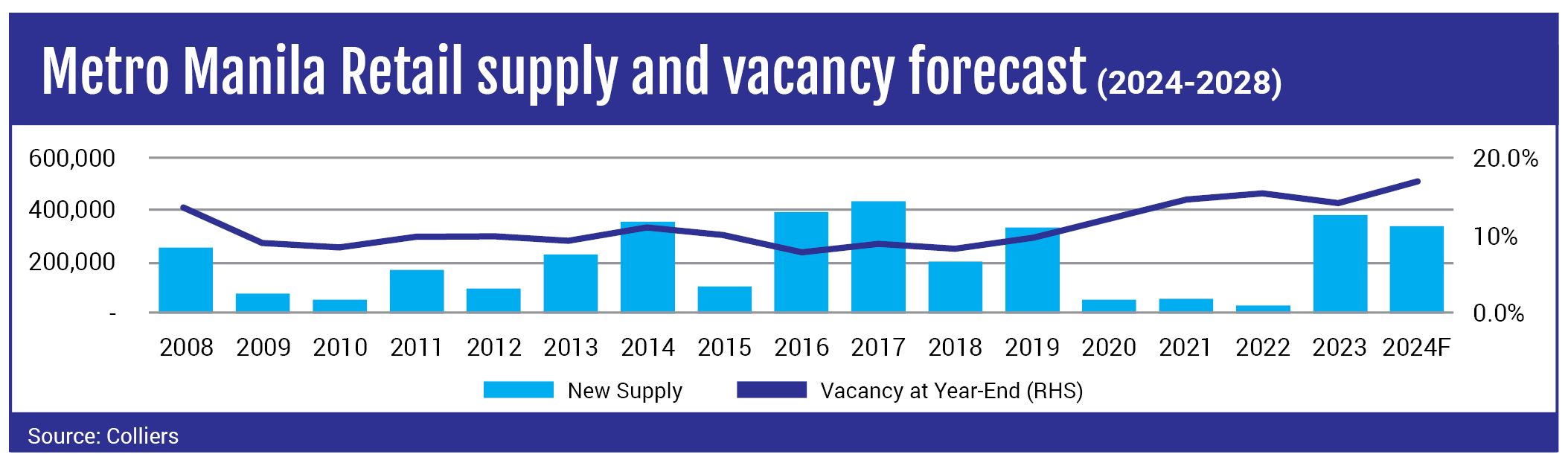

Retail space demand for 2024 is seen at 85,200 square meters or an average demand for 2024 to 2028 at 121,700 sqm.

In terms of supply, Colliers expects 338,900 sqm of available retail spaces or an average of 97,400 sqm over the next four years (2024-2028). Among the malls due to be completed starting Q2 2024 are: Bridgetowne Opus Mall, Solaire North Retail, SM City Deparo and SM Mall of Asia Expansion.

From 2024 to 2026, Colliers expect the annual completion of 162,300 sqm of new retail space with the Bay Area accounting for half of the new leasable mall space.

As a result, rents are expected to post flattish growth for the remainder of 2024 due mainly to completion of sizable new leasable space in Metro Manila. Vacancy across malls in Metro Manila rose due to the delivery of sizable new retail space. In 2024, Colliers projects vacancy to reach 17 percent and still expect significant completion of new mall space by the second half of 2024.

INNOVATION

Colliers believes that developers operating regional and super-regional malls with expansive activity centers should promote more innovative use of high-density retail spaces. Previously, Colliers highlighted selected Metro Manila malls that are already offering flexible workspaces and vacant spaces as venues for gatherings and occasions.

Aside from actively mounting events in its activity centers, mall operators should explore which events are likely to raise consumer traffic and encourage mallgoers to stay longer and spend more.

There’s no doubt that there has been a heightened propensity for consumers to visit physical malls particularly given the new foreign retailers that have set up shop in the country, Colliers added.

“The challenge for mall operators and retailers now is how to sustain consumer footfall and entice more Filipinos to spend amid elevated interest rates and as inflation rises again after easing in January,” it added.

Colliers recommends that retailers should also consider locking in spaces in business districts that continue to record strong office and residential leasing activities. Those planning to open physical stores should also explore hubs that will be turning over new condominium units and office towers over the next 12 months.

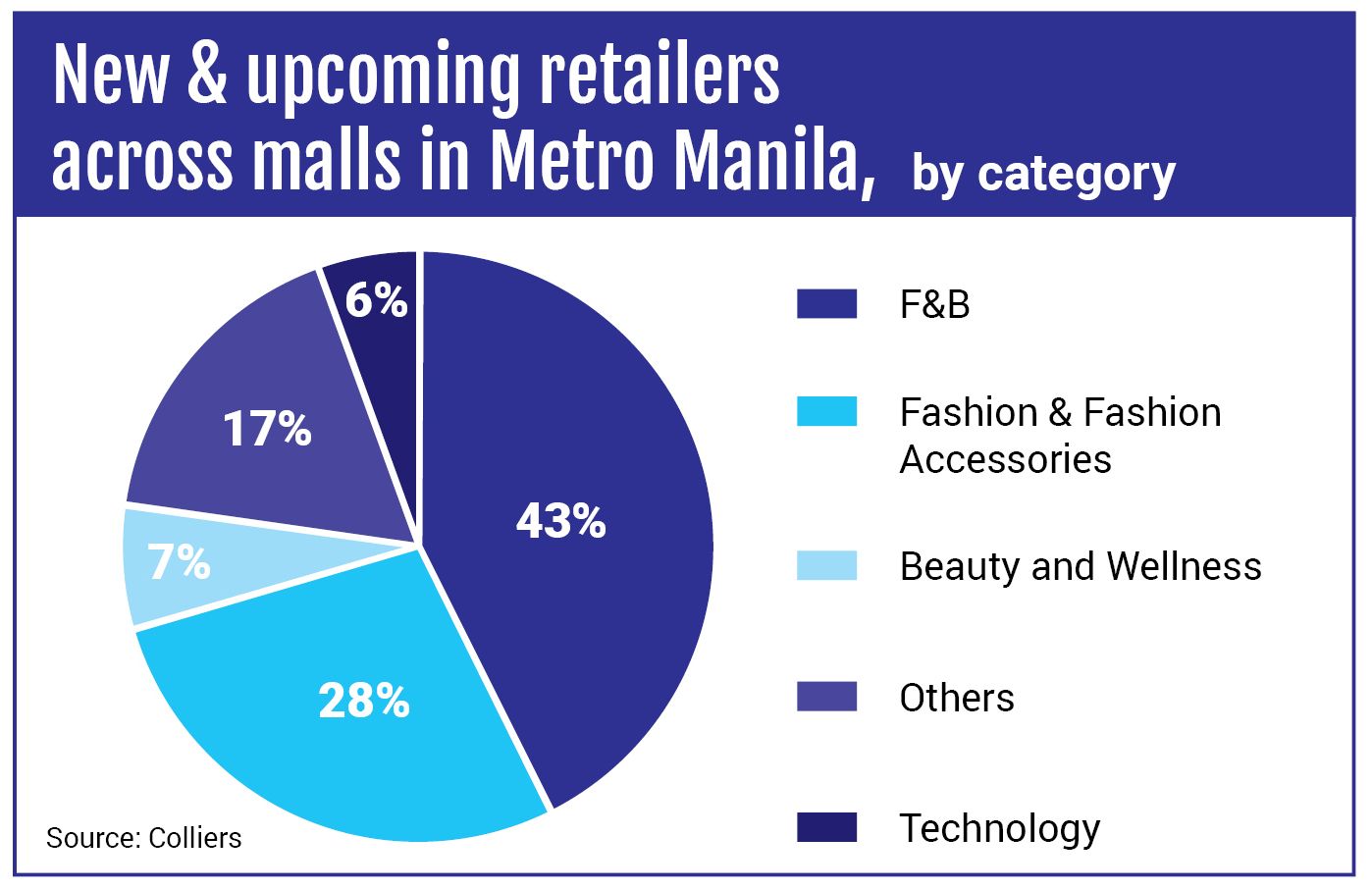

Food and Beverage (F&B) retailers and fast fashion will continue to dominate mall space take-up in the next 12 months.