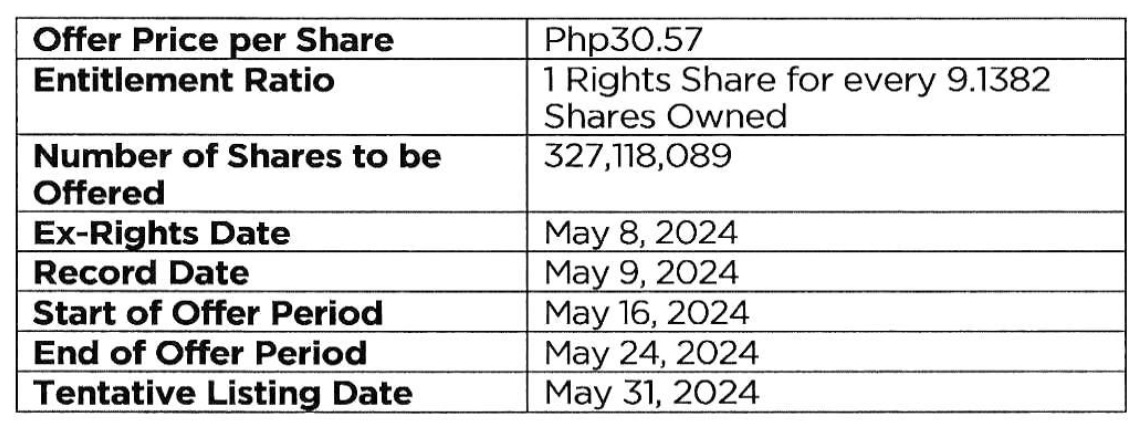

Aboitiz-led Union Bank of the Philippines has set the terms and timetable for its P10- billion stock rights offering with the offer price set at a discounted P30.57 per share.

In a disclosure to the Philippine Stock Exchange the bank said the offer price was determined based on the volume-weighted average price of its common shares traded on the bourse for each of 15 consecutive trading days immediately prior to (and excluding) May 2, 2024, subject to a discount of 25 percent.

After the price has been set, the entitlement ratio is pegged at one rights share for every 9.1382 shares owned for a total offering of 327.12 million UnionBank shares.

The bank said the ex-rights date will be on May 8, 2024 for the record date of May 9, 2024. The stock rights offering will run from May 16 to May 24, 2024.

UnionBank said net proceeds will be used to fund the capital infusion to UnionDigital, projected retail loan availments, and for general corporate purposes.

The bank expects to perform better in the coming quarters after reporting a 41 percent drop in net income to P2 billion for the first quarter of 2024 from the P3.4 billion earned in the same period last year due to costs related to the integration of Citi’s consumer business.

“Our first quarter performance is in line with our expectations. We are even ahead in terms of key metrics that matter for sustainable growth, such as number of retail customers, net interest margins, and fees-to-assets,” said UnionBank Chief Financial Officer Manuel R. Lozano.

He noted that, “Now that we have successfully completed the Citi migration, we will no longer bear the one-time costs associated with it starting this month. We will now focus our efforts to realizing the full gains from cross-selling to our growing customer base.”

The bank said its topline revenues remain strong, growing by 14 percent to P18.35 billion from P16.1 billion in the first three months of 2023.

“This is attributable to the growing proportion of consumer loans, higher net interest margins, and transaction fees,” it added.

Net interest income grew by 17 percent to P13 billion driven by a 59bps improvement in net interest margins now standing at 5.7 percent. Non-interest income excluding trading gains, went up by 13 percent to P4.7 billion.

The Bank said its consumer loans now account for 59 percent of total loan portfolio, nearly three times higher than industry average.

UnionBank allocated resources towards the migration of the acquired Citi Consumer business into UnionBank systems. While this temporarily affected our profitability, it was a planned initiative aimed at unlocking long- term benefits and efficiencies.

On March 24, 2024, the Bank successfully completed the final phase of the Citi integration, which involved the transfer of millions of customer and transaction records from Citi to UnionBank’s platforms.

The Bank's operating expenses rose by 10 percent to P11 billion, driven by IT-related costs supporting the successful migration of Citi retail accounts into UnionBank systems. A one-time integration cost of P1.1 billion was incurred in the first quarter of 2024.

Additionally, the Bank’s marketing investments resulted in a significant increase in new-to-bank credit card customers; more than doubling last year’s customer acquisition rate.

“We now have a bigger base of customers who we can offer our other products and services to,” the Bank said.

Total assets as of March 2024 ended at P1.1 trillion. Total loans reached P521 billion, while low-cost CASA deposits were at P431 billion.