WALA LANG

A local Benjamin Franklin might have said, nothing is certain except death and the BIR. That usually means “Letter of Authority” and other bad news. President Ferdinand R. Marcos Jr. signed R.A. No. 11976 into law, the Ease of Paying Taxes Act (“EoPT”) a few weeks ago. Designed as part of the government’s thrust to modernize the Philippine taxation system and to increase compliance, much of it is good news, although some parts may not be entirely so.

The law’s Implementing Rules and Regulations (IRR) are still under discussion. In the meantime, Jose T. Valencia, Senior Partner of Maceda Valencia and Co., CPAs, gives us a heads up on some highlights.

First, the good news

EoPT makes it easier for taxpayers on matters including the following:

- OFWs who have no income from sources within the Philippines are no longer required to file an Income Tax Return (ITR);

- Taxes can now be paid anywhere—either manually or electronically, even to an authorized tax software provider. Before the change, a 25 percent surcharge was imposed when one filed the return in a wrong venue;

- VAT refunds classified as “low risk” will no longer be subject to pre-audit before the refund is made;

- Taxpayers will be classified into Micro, Small, Medium, or Large based on gross sales, with Micro and Small taxpayers getting concessions on rates of penalty;

- Books and records need to be preserved for a reduced period of five years;

- Transferring the registered place of business from one Revenue District Office to another is easier.

Second, a possible difficulty on invoices

The law requires that invoices show the amount of sales, VAT, name, and TIN of both the purchaser and issuer/seller, description of goods or nature of services and the date of the transaction for it to qualify for input VAT credit.

While this makes sense, claiming input VAT on purchases of goods and services could be challenging because sellers are not always meticulous. The required information should be shown in the invoice for the transaction to qualify for input VAT credit, otherwise the claim for input VAT may be disallowed by the BIR.

Third, a toughie on the sale of services

Before EoPT, the 12 percent Value Added Tax (VAT) was based on gross receipts, which means VAT was payable upon receipt of payment. Under EoPT, VAT on sales of services is based on gross sales derived from the sale or exchange of services, including the use or lease of properties, which means the tax basis for the VAT (which is due quarterly) is the sales invoice and not the official receipt.

The intention of Congress could have been to simplify matters, since a separate VAT official receipt no longer needs to be issued for sale of services, including leases. Matters become complicated, however, when receivables are not collected soon after the service is rendered and when a receivable proves to be uncollectible, often a disputed issue. Furthermore, the seller of services would need to advance VAT payments, requiring an increase in working capital.

EoPT allows the deduction from the VAT due at the end of the quarter (based on sales invoices issued during the quarter), the VAT on uncollected sales invoices. More specifically, EoPT provides that “a seller of goods or services may deduct output VAT pertaining to uncollected receivables from its output VAT on the next quarter, after the lapse of the agreed upon period to pay,” on the condition that the seller has fully paid the VAT on the transaction and provided the related invoice had not been previously written off and claimed as a deductible expense for income tax purposes.

The above relief will mitigate but not completely eliminate the need for additional funding. Even for invoices that are due and payable upon issuance, the VAT deduction for uncollected receivables can only be claimed the next quarter. The additional funding requirement may be more for service businesses offering a credit term of 30 to 60 days for their customers.

To properly comply with the amendments under EoPT, especially with respect to VAT on sale of services, the service business owner needs to generate the list of outstanding invoices that are past due, and the corresponding VAT thereon. This will be difficult and time consuming for businesses that are still maintaining a manual set of books. This suggests that it may be time for them to look into digital bookkeeping solutions and to consider adopting loose-leaf invoices whereby details of a sale transaction are printed on duly accredited sales invoices, thereby doing away with the need to fill out sales invoices manually.

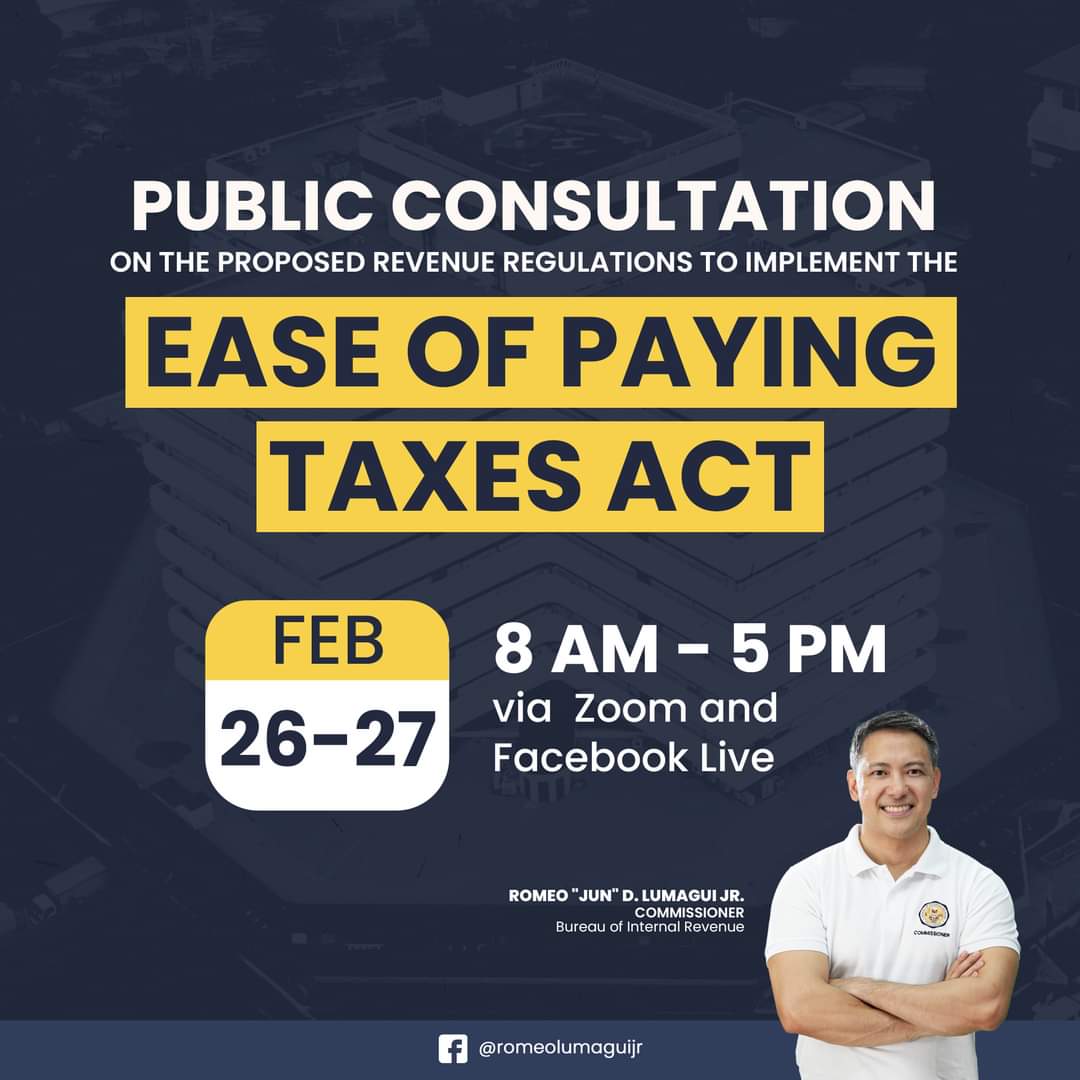

The BIR is conducting public hearings on the proposed IRR and, with hope, the wrinkles can be ironed out. Taxpayers are usually given six months to comply from the effectivity date.

Note: Jose T. Valencia is a senior partner at Maceda Valencia & Co., a member firm of NEXIA International, a network of independent accounting firms worldwide. For general information only, this article is not intended to be, nor is it a substitute for, informed professional advice. While due care was exercised to ensure the quality of the information contained in this article, readers should carefully evaluate its accuracy, completeness, and relevance for their purposes, and should obtain any appropriate professional advice relevant to their particular circumstances. For comments or inquiries, email [email protected]).

Comments are cordially invited, addressed to [email protected].