The tide may finally turn for the Philippine Stock Exchange index (PSEi) which is forecast by Philstocks Financial to grow 8.51 percent to 18.84 percent this year on the back of robust economic growth, lower inflation, stronger peso, and interest rate cuts.

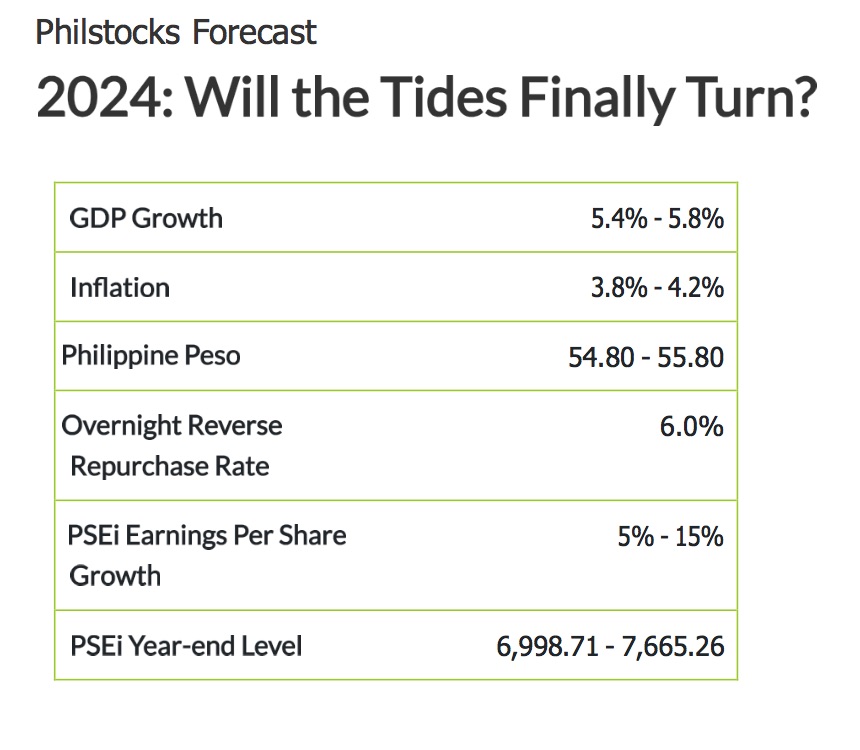

Philstocks Research Head Japhet Tantiangco said this forecast is hinged on the assumption that earnings per share of PSEi member companies by five percent to 15 percent.

For 2024, Philstocks projects the Philippine economy to grow by 5.4 percent to 5.8 percent with the base case projected growth of 5.6 percent hinging on the assumption that the labor market will remain healthy; inflation will decelerate this year; and easing of monetary policies.

“Household consumption is still expected to be the main driver of growth backed by the country’s healthy labor market. Consumption is also expected to further strengthen once inflation subsides,” said Tantiangco.

Inflation is forecast to average within 3.8 percent to 4.2 percent, lower than 2023’s six percent. However, there is risk that inflation will be higher due to higher consumption amid impact of El Niño on food supply.

Tantiangco said the peso may appreciate this year and average at P54.80 to P55.80 per dollar on the assumption that Philippine Balance of Payment will continue to post a surplus due to higher remittances, inflows from service exports, and a rebound of foreign direct investment net inflows.

Meanwhile, Tantiangco said the Bangko Sentral ng Pilipinas (BSP) may start easing monetary policy and the overnight reverse repurchase rate will be at six percent by the end of 2024 on the assumption that inflation will remain within the government’s target.

“The robust economy is still expected to help in our corporates’ profitability, mainly through the strengthening of their revenues. The continuous growth of the economy is expected to lead to higher incomes on an aggregate level which in turn would sustain the demand for our corporates’ products,” he noted.

Tantiangco added that, “a slowdown in inflation is also seen to help in boosting revenues especially of our consumer leaning companies. Rising input costs and high interest expenses however are seen as risks to company bottom lines.”

Meanwhile, he said sentiment is still seen to pose downside risk against Philstocks’ projections which may not be met this year if sentiment turns bearish in case economic growth sharply decelerates or inflation falls far from the government’s 2 percent to 4 percent target.

Other risks include the BSP deciding not to ease its monetary policy this year of if the US Federal Reserve does not follow up on its hint of doing three 25 basis point rate cuts in 2024.

From a technical standpoint, Philstocks Assistant Research Manager Claire Alviar said that “we're still seeing the market moving upwards, particularly with the appearance of the golden cross—a strong buying signal of the moving average crossover.”

“However, the momentum is weakening, as shown by the price movement divergence with the 14-day Relative Strength Index. This could mean a drop to around 6,400 and possibly even lower to 6,150. Take note that the 6,700 level is also a strong resistance level," she added.

“Despite falling at the 6,150 level, the PSEi would still be in an uptrend movement, forming a higher low, and that would be a good entry point. Then if it surpasses the 6,700 level, a minor resistance is anticipated at 6,800, and a strong one at the 7,000 level,” she also said.

For investment, Philstocks is looking at the banking, energy, property, and consumer sectors.

“For 2024, we see a better outlook for the consumer sector. Given that inflation is expected to slow down and that the labor market remains healthy, spending could see an improvement this year on both the staple and retail front,” said Philstocks Research and Engagement Officer Mikhail Plopenio.

He noted though that, “growth could be tempered for retailers with non-essential products such as big ticket items and luxurious items as we see that households will focus on essential needs amid elevated inflation.”