FROM THE MARGINS

Decades ago, I started my microfinance journey by providing credit to landless rural women for enterprise and community development, with a holistic vision of fighting poverty. I have seen firsthand how microfinance can improve people’s lives. By offering a myriad of financial and social services, microfinance institutions (MFIs) do not only help poor vulnerable households address their immediate needs. They provide access to resources that enable people to transform their lives in the long-term.

There had been many studies and client testimonials documenting the transformative impact of microfinance. Just last Nov. 25, economist Jan Carlo “JC” Punongbayan of the WeSolve Foundation presented to industry representatives and government regulators a study on the impact of microfinance on income and consumption smoothing, which was based on their groundbreaking Philippine Microfinance Survey. The subsequent panel discussion proved highly insightful, with experts and practitioners examining the study’s implications for shaping microfinance policy and practice in the Philippines.

Income and consumption smoothing

Consumption smoothing is an economic concept that explains how individuals adjust their spending patterns in response to fluctuating income levels throughout different life stages. The ability to smooth consumption is critical for poor households, as they have limited income and few assets to rely on during disruptions such as death, illness, unemployment, or natural disasters. Lacking ways to mitigate income loss, they cope by borrowing money, cutting back on food and necessities, postponing medical care, deferring their children’s education, and delaying home repairs. These actions, in turn, push them further into poverty.

The WeSolve study found that microfinance helps poor households stabilize consumption and avoid extreme poverty, with the greatest benefits seen among the poorer households.

Our experience as a microfinance provider confirms this. We begin by offering small loans to help clients start microenterprises and generate income, while providing training on credit discipline and financial literacy. We increase loan amounts based on their performance. In cases when clients, due to economic difficulties, use part of their loans for family needs, intervention is done in center meetings to ensure that funds are reinvested to promote business growth. We offer other products/services to help them.

Thus, the immediate impact of microfinance is increased income, primarily from livelihood loans. As businesses stabilize, borrowers gain access to other loans, such as for education, housing, emergencies and microinsurance. Microinsurance acts as a safety net, helping clients manage unexpected losses.

The WeSolve study’s finding that microfinance enables poor people to manage income disruptions and economic downturns offer a valuable foundation for understanding how microfinance contributes to poverty alleviation.

Beyond credit

Microfinance is the heart and soul of financial inclusion because it targets poor and vulnerable households. Its goal is not just to ensure that everyone has access to useful financial tools; it wants to make sure that those tools would positively benefit those living in poverty. Microfinance goes beyond credit and covers a broad range of services, including savings, microinsurance, remittances, education, healthcare, disaster relief, and other interventions.

MFIs offer more than enterprise development loans. They have emergency, health, education, home renovation and other loans to address the diverse needs of low-income families. They also provide microinsurance products, including agricultural, health, business interruption, and disaster coverage, along with pre-need products like education, life or memorial services, and pension. Additionally, MFIs offer non-financial services like financial literacy training, marketing support, community development, and relief during disasters. The end-goal? To ensure that financial services help clients address other aspects of their lives that keep them trapped in poverty.

Contributing to SDGs

In 2019, the University of Cambridge Institute for Sustainability Leadership published a study assessing how one of our affiliates, a microinsurance mutual benefit association, contributes to the Sustainable Development Goals (SDGs). The study, “Mutual Microinsurance and the SDGs: An Impact Assessment after Typhoon Haiyan,” found that mutual microinsurance can contribute to the SDGs by increasing the protection and resilience of low-income communities, highlighting the interdependence of microfinance and microinsurance in post-disaster recovery.

A 2023 impact study done by WeSolve on our microfinance-oriented group of institutions confirms that we are contributing to 10 out of the 17 SDGs. Using the government’s Ambisyon 2040 as framework to assess impact, the study found that:

“Significant improvements can be seen in members’ lives during their membership with the MFI. These were evident in aspects of the clients’ personal goals, community life, occupation and livelihood, education, housing, and health behaviors.”

Dr. Takayoshi Amenomori also did a case study of our institution in 2023 and found that our program for the “hardcore poor” or those in extreme poverty had been successful, although further interventions are needed to lift them out of poverty.

We have come a long way, but we still have far to go. As microfinance industry players work tirelessly to expand and enhance our services, these researches inspire us in our collective efforts to make poor people’s lives better.

* * *

“Research is creating new knowledge.” – Neil Armstrong

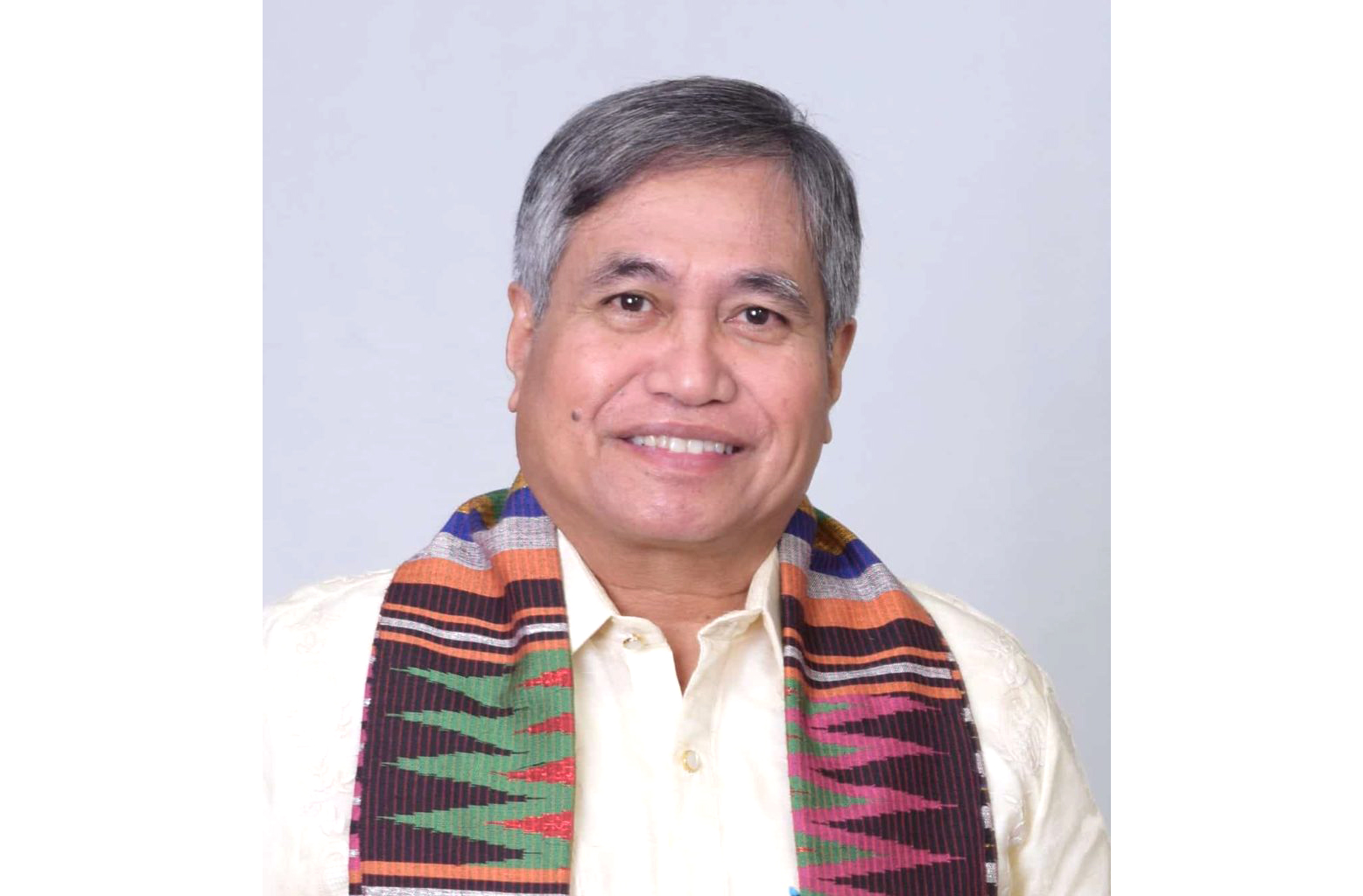

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)