The recent enactment of the Corporate Recovery and Tax Incentives for Enterprises, or CREATE MORE law, promises to catalyze economic reforms by providing a more competitive landscape for local and foreign investors in two vital ways: first, creating a comprehensive framework for tax incentives, including corporate taxation; and secondly, by promoting ease of doing business. However, its full-scale impact will be measured by how effectively it complements other efforts, particularly the US government’s initiatives to revitalize the Philippine economy through strategic investments in key regions like Central Luzon and New Clark City.

The CREATE MORE law is designed to encourage foreign direct investment (FDI) by offering a streamlined tax system, improved incentives for businesses, and support for industries such as manufacturing, information technology, and tourism. At its core is its revision of the tax incentives system, which now focuses on performance-based incentives tied to specific outcomes, rather than blanket tax holidays. This targeted approach ensures that businesses receiving incentives are more likely to contribute meaningfully to the Philippine economy, whether through job creation, infrastructure development, or technological innovation.

The law also reduces the corporate income tax rate from 30 percent to 25 percent – the lowest in Southeast Asia – which is expected to improve the country’s attractiveness as an investment destination. This reform alone could enhance the Philippines’ competitiveness, particularly when compared to neighboring economies with higher tax rates. It also addresses the administrative complexities faced by businesses, aiming to reduce the time and cost involved in compliance with regulations.

Propitiously, this complements the U.S. government’s initiatives to revitalize the Philippine economy by piloting development projects in the Central Luzon corridor and New Clark City, that are poised to align seamlessly with the objectives of the CREATE MORE law. These initiatives are strategic: Central Luzon is already a burgeoning industrial hub, and New Clark City is being developed as a modern, sustainable urban center aimed at decongesting Metro Manila.

US companies investing in infrastructure, green energy, or smart city technologies in New Clark City will certainly find the new tax incentives attractive, encouraging them to bring in capital and expertise. The law’s focus on modernizing infrastructure, in parallel with the US government’s investments, will likely accelerate the development of this area as a prime economic zone.

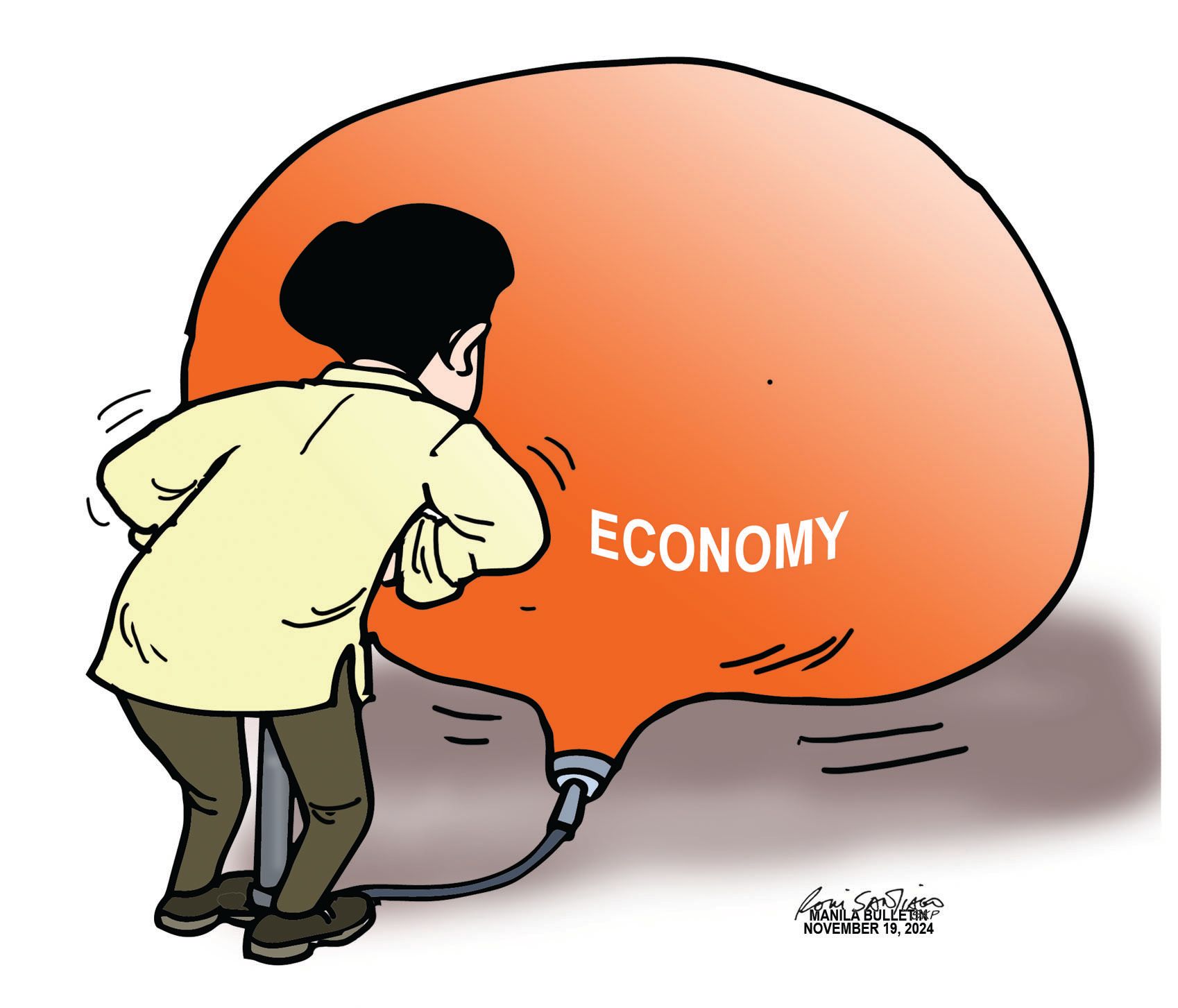

This could bring about a “snowball effect.” As the region’s infrastructure and business ecosystems improve, both US and local companies will be better positioned to leverage the benefits of the CREATE MORE law, resulting in a faster-paced recovery and expansion of the Philippine economy.

The Anti-Red Tape Authority’s (ARTA) Ease of Doing Business (EODB) program is crucial in ensuring that the objectives of the CREATE MORE law are fully realized. However, while ARTA’s initiative is commendable, its capacity to deliver tangible improvements has been limited, with reports indicating that only about 100 EODB efforts have been implemented annually. This gap in implementation can slow the realization of the law’s potential.

Synergy is key. Tax reform, infrastructure development, and regulatory streamlining must converge to attain the lofty economic development objectives. ARTA must accelerate efforts to remove bureaucratic hurdles by fast-tracking processes like permits, licensing, and land conversion. Only through a coordinated, high-speed implementation of reforms can the Philippines truly unlock its economic potential and emerge as a leading player in the global market.