FROM THE MARGINS

As I am writing this article, Typhoon Julian is unleashing violent winds and heavy rains over Northern Luzon, prompting officials to evacuate villagers, close schools and halt inter-island ferries. News reports showed the slow-moving super typhoon wreaking havoc in Cagayan and Batanes, flooding many areas, and destroying thousands of houses and coastal villages.

Climate change is real, and we all need to brace ourselves.

The financial sector, under the leadership of the Bangko Sentral ng Pilipinas (BSP), is embracing the sustainability agenda amidst climate change. BSP Circular No. 1085, s. 2020, adopts the Sustainable Finance Framework, which exhorts financial institutions to integrate sustainability principles in their operations and develop products or services for climate change mitigation and adaptation. In 2022, BSP also launched the Sustainable Central Banking Strategy to address the potential impact of climate and environmental risks on the prices of goods and services and on the safety and soundness of financial institutions.

Heeding the call

In February 2024, the Board of Trustees of the Rafael B. Buenaventura Microfinance Resource Center Foundation (RBB Foundation) made a courtesy call to BSP Governor Eli Remolona. With me were former Prime Minister Cesar Virata, Leonilo Coronel, Roberto Panlilio, and Benjamin Castillo. The other Board members, Cesar Buenaventura and Deogracias Vistan, were not able to join us, but two financial industry leaders were with us: Jose Teodoro Limcaoco, president of the Bankers Association of the Philippines and Eduardo Jimenez, Vice-Chairperson of the Microfinance Council of the Philippines.

I recall Governor Remolona’s warm response to our ongoing initiatives to support BSP’s financial inclusion agenda, like the promotion of QRPH, digitalization, support to MSMEs, and others. But he also challenged us: wouldn’t you like to integrate climate change adaptation to your operations?

We are responding positively to this challenge. Apart from strengthening the capacity of microfinance institutions (MFIs) on digitalization, agriculture value chain, and MSME financing, we are including climate adaptation and sustainability in our training programs. Just last week, we organized an online focused group discussion (FGD) with 25 participants from 11 MFIs, to discuss how to support BSP’s sustainable finance advocacy.

MFIs’ response

Prior to the FGD, we administered a questionnaire to gauge the participants’ awareness and interest in climate change issues. According to Patricia Calilong, RBB Foundation’s executive director, the pre-FGD survey showed that:

- 48 percent of respondents have a moderate level of awareness of climate adaptation and resilience. 28 percent of the respondents were slightly aware and 24 percent were very aware.

- 100 percent of the respondents believe that their organizations have a role to play in climate change adaptation.

- Almost all (96 percent) of the respondents have noticed the impact of climate change, citing agricultural damage, displacement, and loan delinquency among clients.

- The respondents identified the following as needed support in climate change adaptation: for their clients - financial support (loans, savings, microinsurance), business advisory, and educational services; for their organizations - technical and institutional capacity enhancement and collaboration; and support for their staff and clients in leveraging technology for education and online training.

The FGD yielded a three-pronged approach to bolster MFIs’ sustainability programs:

1. Supporting partnerships between banks and MFIs. It was mentioned that some commercial banks have green/blue financing windows that MFIs can access and utilize as conduits.

2. Provision of technical assistance to MFIs. The BSP, RBB Foundation and other groups could train MFIs on how to : (a) apply/enhance available climate risk assessment tools, incorporating them into loan appraisals; (b) design financial products for climate resilience, such as crop insurance, solar loans, and greenhouse loans; (c) monitor and assess the impact of climate risks for their organizations and clients, integrating their findings into loan appraisals and operational strategies; (d) demonstrate the benefits of climate adaptation to clients; (e) prioritize investments in sustainable infrastructure and technologies, like resilient housing, solar energy systems, and digitalization to reduce paper use; (f) expand disaster preparedness and climate resilience training for staff and clients using online platforms and social media; (g) collaborate with government, international organizations, and other MFIs to share best practices and resources; (h) create platforms for knowledge sharing and collaboration to enhance collective climate resilience.

3. Advocacy. Advocate for government infrastructure, such as roads and bridges (especially those supporting farm-to-market access), to be insured. This will ensure the smooth flow of agricultural goods and services, protecting both farmers and consumers.

It is important for the microfinance industry to heed the call for sustainability because our country is extremely vulnerable to natural disasters and our clients – the poor and disadvantaged — suffer the most whenever disasters strike. We know because we are usually the first responders due to our strong community presence.

MFIs, perhaps, more than any other financial institution, understand the impact of climate change disruptions on vulnerable people and communities, on businesses and livelihood. It is important for all of us to adopt sustainable practices.

* * *

Climate change is real. It is happening right now. – Leonardo di Caprio

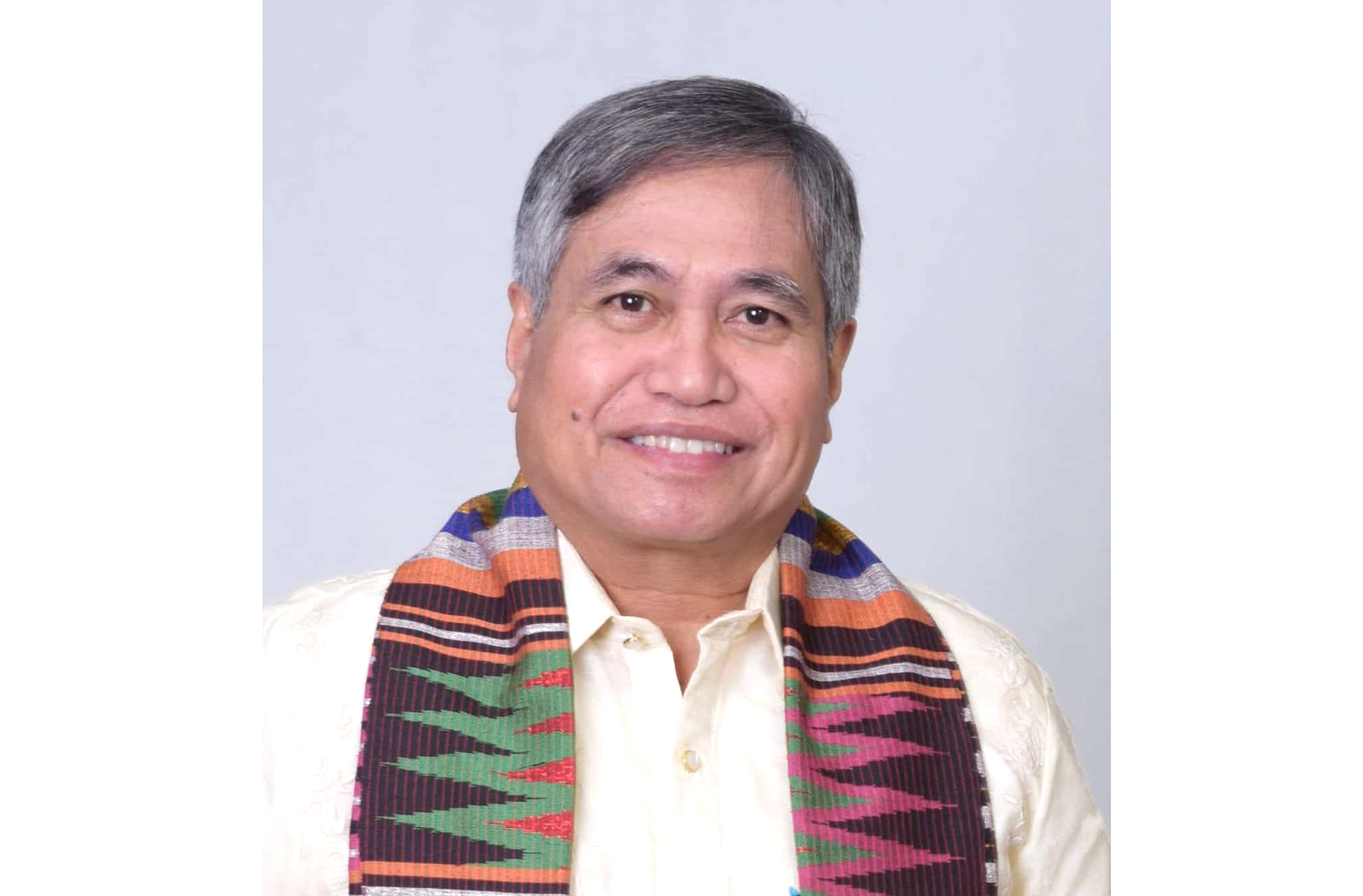

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)