The Bangko Sentral ng Pilipinas (BSP) has further reduced the rates on its peso rediscounting facility effective Jan. 9, 2024.

Rediscounting is a BSP credit facility extended to qualified banks with active rediscounting lines. The facility helps banks meet their temporary liquidity needs by refinancing the loans they extend to their clients using the eligible papers of its end-user borrowers.

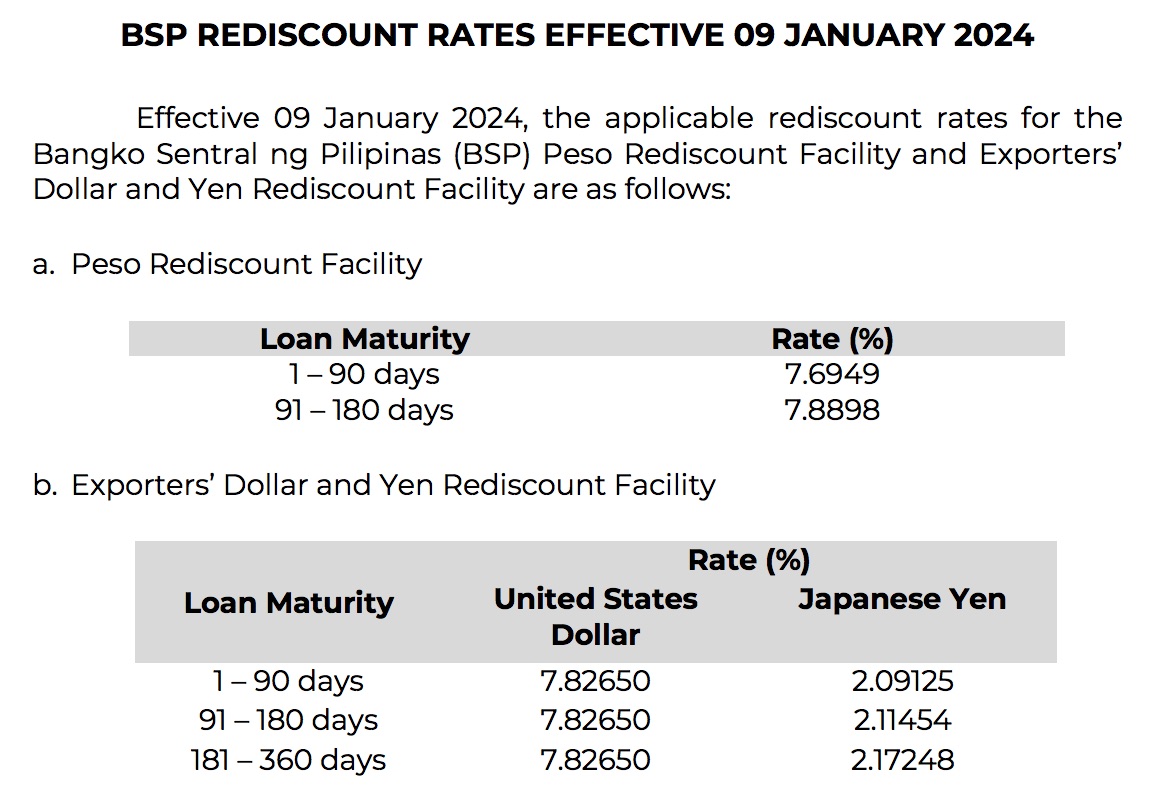

Starting Tuesday, Jan. 9, the applicable rediscount rates for the BSP Peso Rediscount Facility are 7.6949 percent for 1-90 day maturity, and 7.8898 percent for the longer 91-180 day maturity.

The rate for the 1-90 day maturity is lower compared to the previous rate of 7.7303 while for the 91 to 180-day tenor, the previous rate was also higher at 7.9606 percent. The peso rediscount rates are based on the BSP overnight lending rate.

The BSP reiterated that the “appropriate spread on rediscount rates, as may be determined by the BSP, may change periodically to complement the changes in the BSP’s monetary policy goals and reflect movements in market interest rates.”

The Exporters’ Dollar and Yen Rediscount Facility (EDYRF) rates, which are based on the applicable benchmark rates, will also see some changes.

Beginning January 9, 2024, the EDYRF rate for US dollar-denominated rediscounting loans will be lower at 7.82650 percent for 1-90 days, 91-180 days and 181-360 days.

For the yen-denominated EDYRF, the rates will be higher at 2.09125 percent for the 1-90 days but lower at 2.11454 percent for the 91-180 days and 2.17248 percent for the 181-360 days.

The prior EDYRF rate for US dollar-denominated rediscounting loans is 7.8700 percent for 1-90 days, 91-180 days and 181-360 days. For the yen-denominated EDYRF, the rates are as follows: 2.09000 percent for the 1-90 days; 2.11500 percent for the 91-180 days; and 2.17980 percent for the 181-360 days.

The BSP did not disclose if there were new availments for the rediscounting facility for the month of September, October, November, and December. It is assumed there were no takers for the facility since September this year despite that the BSP did not stated as such.

From January to August 2023, the BSP said no banks tapped the facility. One of the reasons for this is because the financial system is awash with cash and there was no need to borrow from the BSP for liquidity purposes.

At the end of 2022, total peso rediscounting loans amounted to P15.3 billion. Meanwhile, the last time banks availed of the EDYRF was in 2016.

The facility operates as a temporary liquidity loan for banks to extend to their clients with eligible papers such as credit instruments including promissory notes, drafts or bills of exchange for commercial credits.

Production credits are also allowed which are used for production or processing of agricultural, animal, mineral, or industrial products. Other credits or special credit instruments such as, but not limited to, microfinance, housing loans, services, agricultural loans with long gestation period, and medium and long-term loans are also accepted.