PH to implement measures vs terrorism financing

By Raymund Antonio and Raymund Antonio

The Philippines is set to implement at least three measures that would stop the proliferation of terrorism financing, or the entry of funds from abroad to finance terrorist activities, an official of the Anti-Money Laundering Council (AMLC) said.

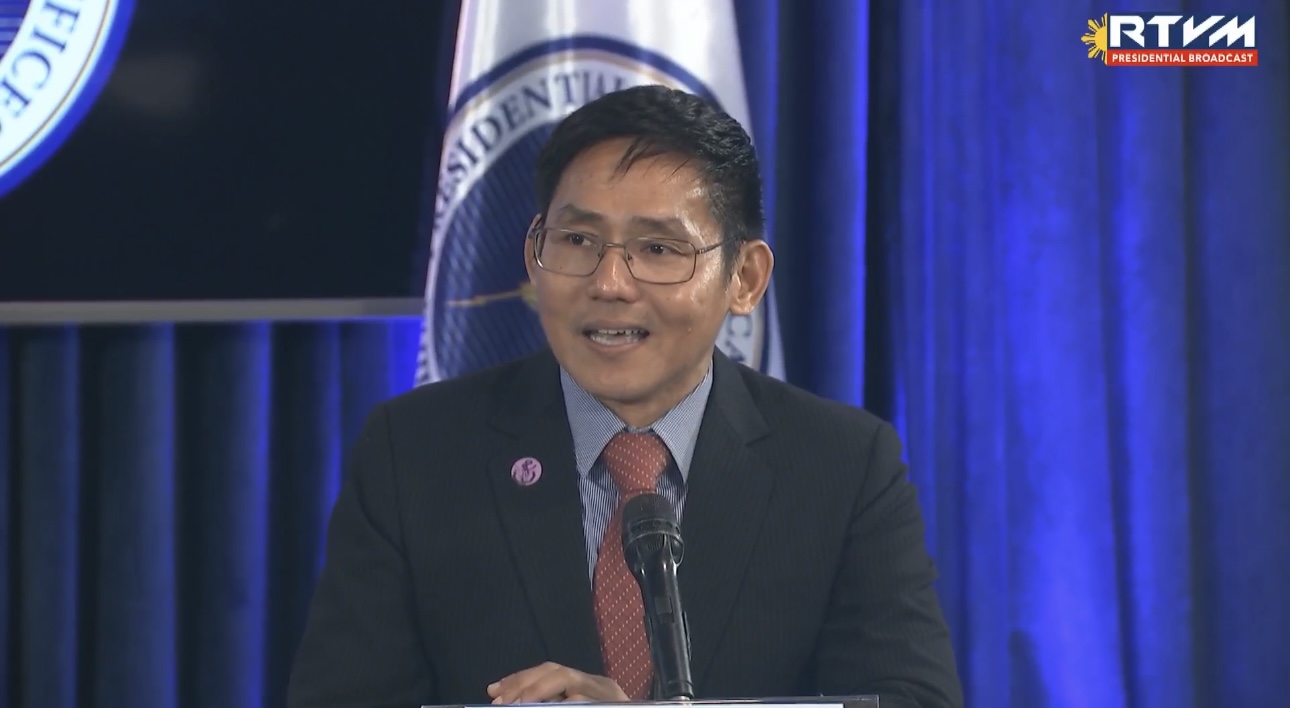

AMLC Secretariat Executive Director Matthew David speaks to the media a Palace briefing. (RTVM screenshot)

AMLC Secretariat Executive Director Matthew David speaks to the media a Palace briefing. (RTVM screenshot)

AMLC Secretariat Executive Director Matthew David revealed the three action items that the Philippines must comply with to address terrorism financing and exit its gray list status under the global anti-money laundering Financial Action Task Force (FATF).

Chief of these three measures is the identification of terrorism financing, which means that law enforcement agencies and the AMLC will have to identity persons of interest or possible terrorist or terrorism financiers.

The two other action items include the investigation of terrorism financing by law enforcement agencies and the prosecution of those involved in financing terrorism.

“Three action items po ito na (These are the three action items that) we need or the law enforcement agencies will have to address eventually as part of our goal to exit the gray list,” David, a lawyer, told reporters during a Palace briefing on Tuesday, Jan. 2.

Under the gray list, countries like the Philippines are at risk of money laundering from casino junkets and lack of prosecution for terrorism funding cases.

The country was included in the gray list in June 2021 by the FATF, an intergovernmental organization combating money laundering and terrorism financing, and has failed to exit the earlier deadline set by the FATF in January 2023.

Marcos said the country will work to exit the gray list by October this year, and directed the AMLC and all concerned government agencies to address the remaining strategic deficiencies raised by the FATF.

David revealed that the AMLC has already filed cases for terrorism financing against organizations, non-government organizations (NGOs), and designated terrorist organizations that are receiving illicit funds from abroad.

These cases, which are an important step in delisting the Philippines from the FATF gray list, are pending in court, the official added.

The Philippines’ inclusion in the FATF’s gray list puts even overseas Filipino workers’ (OFW) remittances in peril as the risk of eventually being blacklisted will lead to the increase in cost, more requirements, and stringent requirements of remittances.

David furthered that some of these transactions might even be delayed or denied because of the “countermeasures” that would be imposed by the FATF on blacklisted countries.

The FATF’s black and gray lists identify jurisdictions with weak measures to combat money laundering and terrorism financing. According to the FATF’s website, the task force already reviewed 129 countries and jurisdictions, publicly identifying 102 of them.

Of that number, 76 have made the necessary reforms to address the weaknesses in their system.

The Philippines remains under the gray list, which means it is actively working with FATF to address strategic deficiencies in their systems. Countries under the gray list are in increased monitoring, reflecting its commitment to swiftly resolve its identified strategic deficiencies.

Some countries with the Philippines in the gray list are Vietnam, United Arab Emirates, Syria, Turkiye, Yemen, and Croatia, among others.