COL Financial, the country’s largest online stock brokerage firm, is cautiously optimistic about the local stock market as it is poised for a bull run although fears of a US recession is holding it back.

“Everything is in place for a bull market in 2024,” said COL Financial Chief Equity Strategist April Lynn Tan in a media briefing.

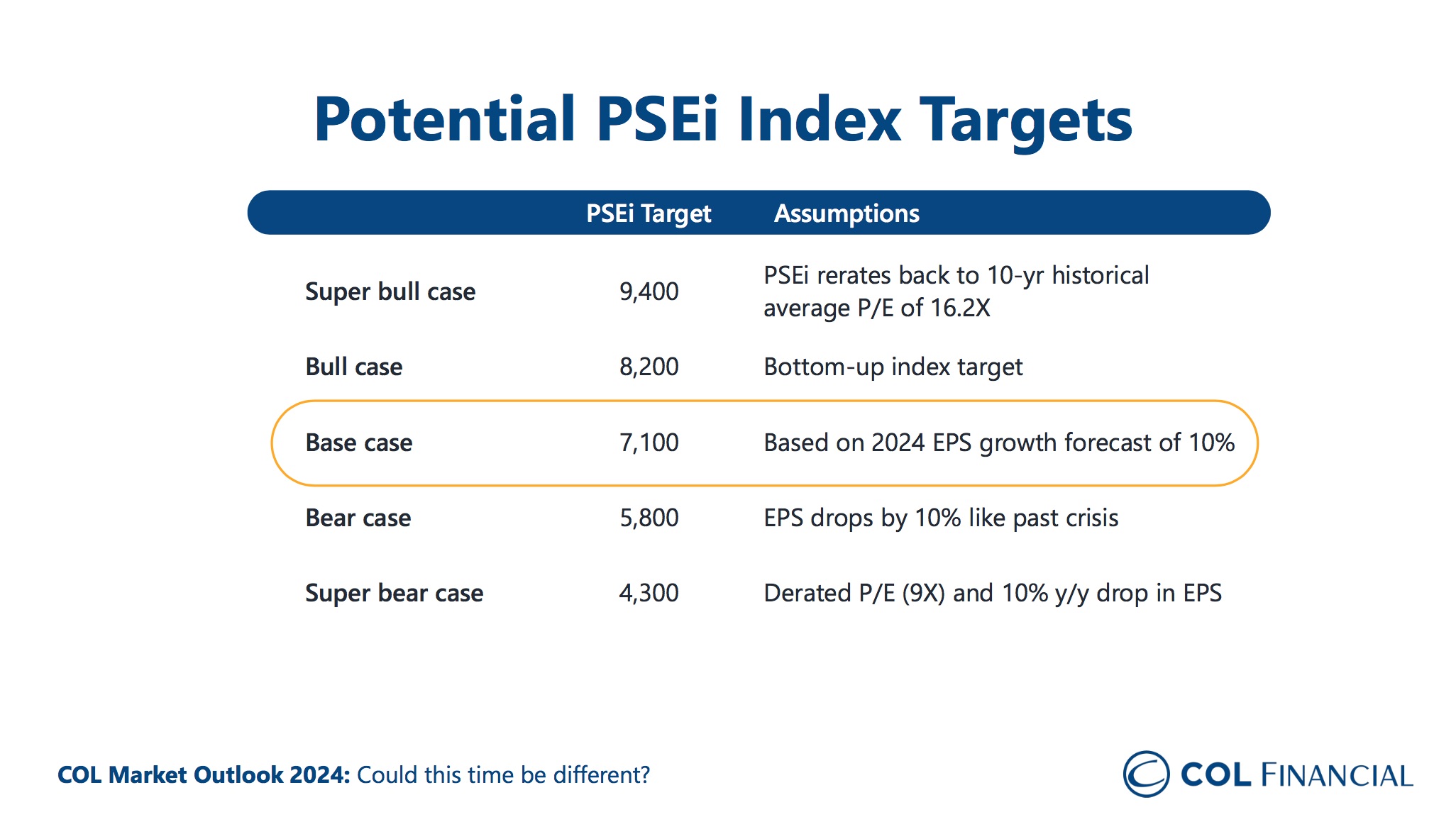

However, in light of risks to the local market, Tan said their base case Philippine Stock Exchange Index (PSEi) target for 2024 is at 7,100 based on a forecast earnings growth of 10 percent while bullish targets are set at 8,200 to 9.400.

However, if feared risks become a reality, Tan said the PSEi could plunge to 5,800 to as low as 4,300.

She noted that inflation and interest rates have peaked and this is seen to spur consumer and investment spending which have disappointed in 2023.

Other factors boosting optimism is that government spending is seen to increase at a faster pace while the Philippines is seen as a domestically driven economy which is more resilient to a global economic slowdown.

“The Philippine is not dependent on exports as consumer spending accounts for 70 percent of gross domestic product,” Tan said adding that, remittances and business process outsourcing revenues are historically resilient to global recessions.

To top it all, Tan said Philippine stocks are now cheap and underowned.

Conversely, risks to the local economy remain as inflation and interest rates could stay elevated in the first half of 2024 while the government’s spending budget is vulnerable to these negative surprises and a weaker than expected economic growth.

Also threatening the market is the possible escalation of geopolitical tensions as well as the heightened risk of a hard landing of the US economy which could lead to a bear market.

Historically, the Philippine stock market has always suffered from a contagion during a US recession.

Meanwhile, COL Chief Technical Analyst Juanis Barredo said, “the PSEi still has one more obstacle at 6,700 but shows good groundings of a bottom.”

However, he warned that, “both the US and the Philippines have stretch marks and could do with some corrections; PSEi support at 6,400 to 6,300 then 6,100 to 6,000 corrections should be taken as better entry windows for positions with potential upsides later at 7,100 to 7,500.”

COL Investment Management President Marvin Fausto noted that a COL survey shows that local investors are getting more confident of a rebound in the market this year, continuing the increase seen since the first quarter of last year.

This is despite investors sharing concern about the potential escalation of geopolitical tensions, a resurgence of inflation, and the El Niño phenomenon.

Tan said investors should focus on more defensive stocks which are more resilient to economic downturns and those that provide income through cash dividends, while pooling a war chest for ready deployment when opportunities for bargain hunting arise.

“It would be wise for investors to keep some cash so they can capitalize on opportunities to buy stocks at even cheaper prices in case they are sold down indiscriminately because of contagion,” she said.