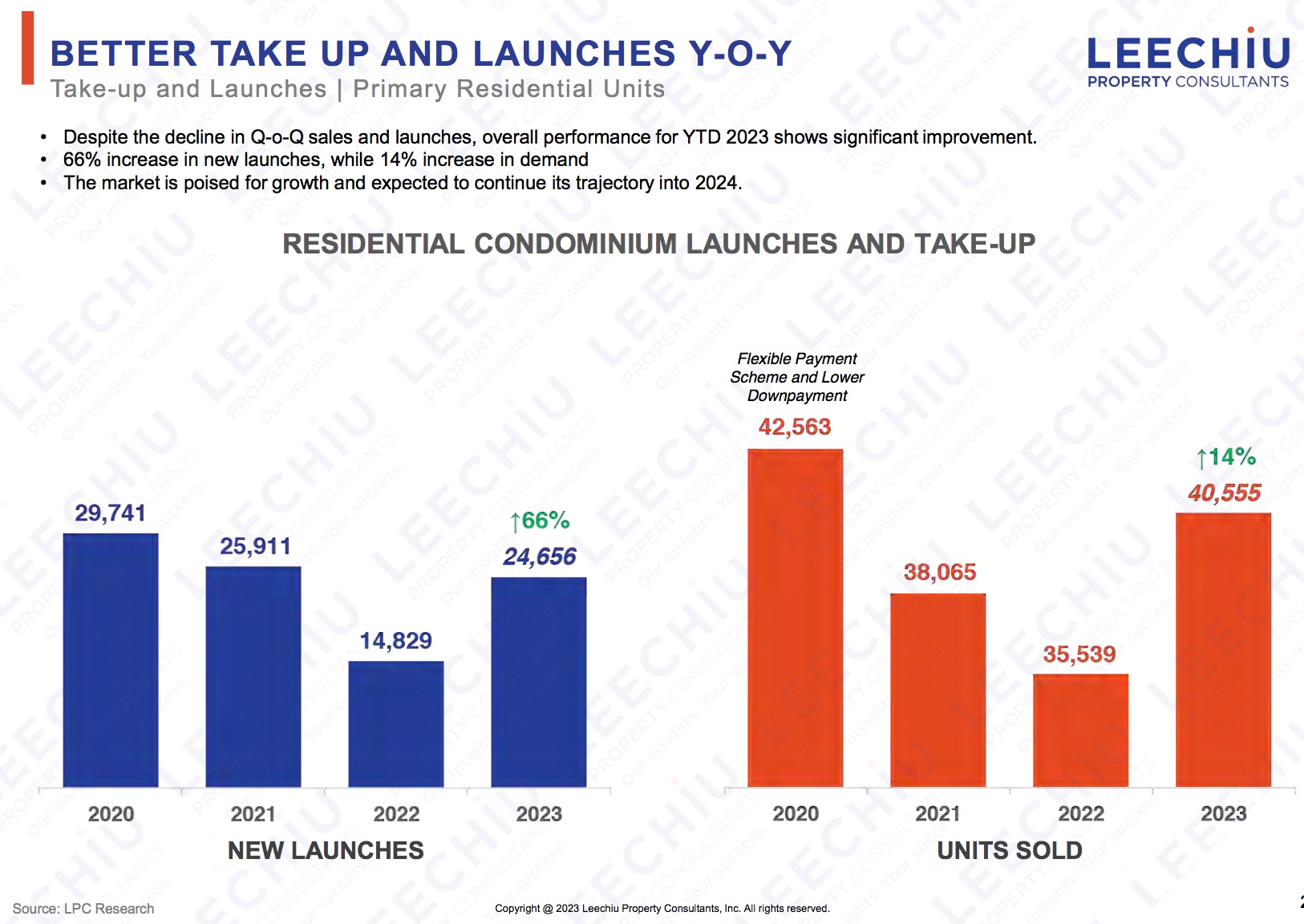

The Philippine residential condominium market marked its recovery in 2023, notably in Metro Manila, which saw a record of 40,555 units sold, according to Leechiu Property Consultants (LPC).

LPC Director for Research and Consultancy Roy Amado Golez Jr. said, “the sector had reached its peak performance two years before the onset of Covid-19 but faced challenges during the pandemic.”

The ensuing market decline prompted developers to offer buyer-friendly payment terms to stimulate demand. However, these measures also increased backout risk.

“In 2023, developers reassessed their sales strategies to balance between increasing sales and mitigating buyer attrition,” he noted.

The market exhibited significant growth, indicating a trajectory toward a more normalized real estate cycle: pre-sales grew by 14 percent, and new project launches surged by 66 percent compared to the previous year.

The first quarter sustained an 8.3 percent increase in pre-sales carried over from 2022, likely stemming from the favorability of payment terms.

As developers adjusted the terms, coupled with stricter buyer screening and requirements, the next three quarters showcased a more stabilized pre-sales landscape.

On the supply side, there was a surge in launches during the first quarter of 2023, reflecting the attractive sales levels achieved.

However, as increased backouts became evident, developers gradually restrained launches to manage inventory, resulting in a 30 percent quarter-on-quarter decline in fourth quarter 2023 launches. Despite this trend, pre-sales remained strong, with 9,720 units sold.

Demand drivers for the sector remain stable, supported by consistent factors such as Overseas Filipino Workers’ (OFW) remittances, projected to close at $36.1 billion, marking a 2.5 percent increase from 2022.

In the first nine months of 2023 alone, remittances increased by 2.8 percent to $27.74 billion compared to the same period last year.

Additionally, the IT-BPM sector continued its impressive growth, generating 130,000 new jobs, reaching a total of 1.7 million full-time employees by year-end.

Despite looming geopolitical uncertainties, the Philippine economy showed signs of growth, achieving a 5.5 percent growth in GDP, surpassing the performance of neighboring Asian countries.

Moreover, the country’s demographic advantage, with a median age of 25, translates to a large potential market for residential projects, further bolstering prospects for sustained growth in the sector.

In addition to the robust demand for residential condominiums in Metro Manila, there’s a growing interest in residential units outside the capital region.

Emerging townships, which are less congested and offer more spacious options, are witnessing increased demand due to lower acquisition costs.

“The market outlook for 2024 signals a shift toward a more inclusive growth. While residential projects within Metro Manila will continue to attract buyers, projects just outside the capital region, particularly in southern fringes, are expected to experience active demand levels,” said Golez.

He noted that, “infrastructure projects spanning the country are fostering enhanced connectivity among provinces, facilitating more widespread development across regions.”

“Townships outside Metro Manila boast relatively lower capital values due to their locations. However, buyers can capitalize on this situation by taking advantage of the opportunities during the pre- selling stage, as property values tend to appreciate upon the completion of infrastructure developments,” said Golez.