Stable interest rate key to more IPOs at PSE - Deloitte

While there is currently a low turnout of initial public offerings (IPOs) at the Philippine Stock Exchange (PSE) this year, more firms are seen to go public when interest rates have stabilized again.

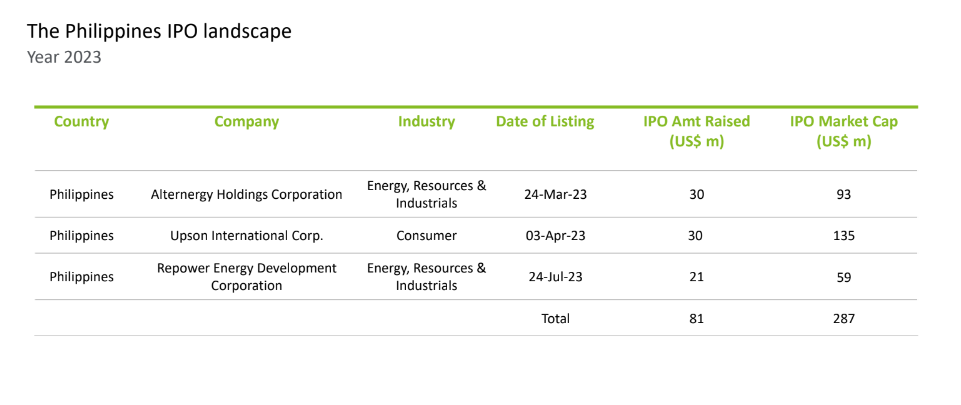

IPOs in the local stock market declined by 77 percent in terms of proceeds raised at $81 million in 2023 with just three IPO listings versus last year’s eight which raised $352 million, Deloitte reported on Thursday, Nov. 16.

The total IPO market capitalization also dropped by 78 percent from last year’s almost $1.3 billion to just $287 million.

This year, three companies were listed at PSE's small, medium, and emerging (SME) board as well as the main board.

These include Alterenergy Holdings Corporation with a $30 million IPO raised amount and $93 million market cap; Upson International Corp. with a $30 million IPO raised amount and $135 million market cap; and Repower Energy Development Corporation with a $21 million raised amount and $59 million market cap.

Deloitte's analysis of Southeast Asia's IPO capital market indicates a slowdown in activity this year due to economic conditions like inflation and rising interest rates.

During a virtual press conference on Thursday, Deloitte Southeast Asia Disruptive Events Advisory Leader Tay Hwee Ling said that the Philippine market will experience a return to IPO listing when interest rates stabilize and settle.

“Moving forward, I would believe that, from a Philippine market perspective... when the interest rate gets a bit more stabilized and settled in the market, [more IPO] listing would have come back,” she said.

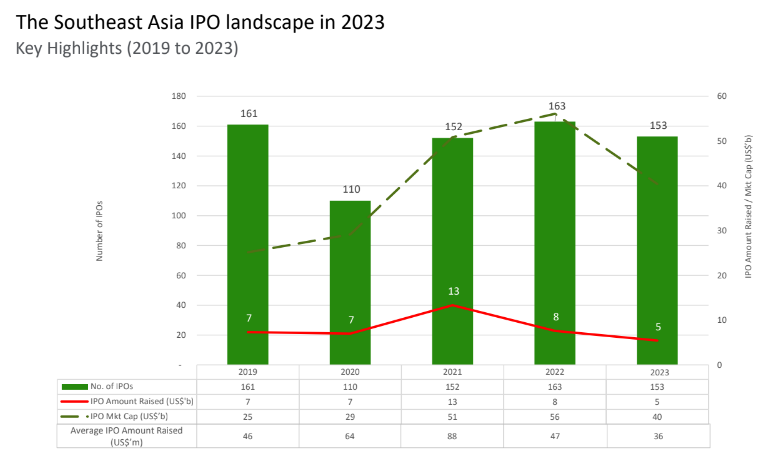

In the Southeast Asian landscape, the IPO capital markets saw a healthy count of 153 IPOs but the total raised amount is seen as the lowest in eight years.

To date, companies in Southeast Asia raised approximately $5.5 billion from this year’s IPO listings, reflecting a 29 percent decline from full year 2022’s $7.6 billion from 163 IPOs.

Indonesia tops the the list for IPO amount raised being the only country in the region which recorded a high growth of 52 percent, while five countries including Malaysia, the Philippines, Singapore, Thailand, and Vietnam, saw a drop in the number of IPOs.

However, there is a discernible trend of more businesses listing in Southeast Asian stock markets' secondary boards, according to the report.

For certain IPO aspirants, the analysis indicated that their listing on the junior boards of the stock exchanges—which serve fast-growing SMEs—may serve as a launching pad to the main board, potentially encouraging them to expand their business and raise more capital.

Further, the analysis highlighted that the Energy and Resources; and Consumer Business are this year’s strongest sectors in the market.

Energy and resources industry

The analysis also revealed that the country is transitioning to renewable energy as a strategy to safeguard its energy security, a trend that is also prevalent in the region.

“Southeast Asian markets and governments have taken strides to seek alternative source of energy and reduce reliance on fossil fuels,” the report stated.

It added that the SEA equity capital market has shifted towards the energy and resources sector, with companies in the electric vehicle (EV) market and renewable energy sectors seeking financing.

In the Philippines, this trend is seen with two companies, Alterenergy and Repower, representing the energy and resources industry.

Alternergy invests in renewable energy projects like wind, solar, hydro, floating solar, and battery storage power, with several long-term power supply agreements for secure offtake markets.

Repower primarily focuses on renewable energy generation and water system management and distribution.

Consumer business sector

Meanwhile, the growing middle class and increasing affluence have led companies in the region to a shift in consumer industry characteristics, with businesses focusing on brand experiences, entertainment, technology, and pet products.

This shift is reflected in the region's evolving demographics, as young people seek experiences beyond basic needs.

Upson, the Philippines’ leading consumer electronics retailer, continues to dominate the market by capitalizing on the growth of the industry, driven by the shift to digital eco-systems; the development of smart cities and smart homes; and the growing popularity of augmented reality (AR) and gamification.