South Korean Ambassador to Manila Lee Sang-hwa said that there was a 4,000 percent increase in South Korea’s investment in the Philippines during the first quarter of this year because of the free trade agreement (FTA) that entered into force on Dec. 31, 2024. In a media luncheon on Tuesday,...

The Philippines declined by one notch to ninth place among the most attractive foreign destinations for Japanese investors in 2024, according to the Japan Bank for International Cooperation (JBIC). In a March 21 publication, JBIC said its latest survey report on overseas business operations by...

The Philippines has emerged as a prime investment destination through tax reforms that have created a favorable business environment for foreign investors, according to a report of property advisory firm Colliers. The report published on Friday, Feb. 28, cited the Corporate Recovery and Tax...

The Philippines is sending a clear message to the world that it is open for business with the signing of the Implementing Rules and Regulations (IRR) of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act. Following...

The recently enacted corporate recovery and tax incentives for enterprises to maximize opportunities for reinvigorating the economy (CREATE MORE) is proving to be a game-changer in attracting global investors, earning praise from Japanese, American, and British business leaders. According to the...

The Philippine Chamber of Commerce and Industry (PCCI) has lauded the signing of the Corporate Recovery and Tax Incentives for Enterprises-Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, saying it will boost investment and simplify tax administration. In a statement,...

(Unsplash) Alyansa Para sa Pagbabago senatorial aspirant Benjamin "Benhur" Abalos Jr. says the newly-signed Republic Act (RA) No.12066, or the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the...

Big business has welcomed the clearer investment rules plus enhanced fiscal perks under the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act. "CREATE MORE will certainly help improve the global competitiveness of the...

Local businesses can now adopt work-from-home setups without losing valuable tax incentives as the newly enacted Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act officially permits flexible work arrangements. The...

Senator Juan Miguel “Migz” Zubiri lauded the signing of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act on Monday, Nov. 11, as it is expected to cut the bureaucratic red tape that has hampered the growth of the...

House Speaker Martin Romualdez (Speaker’s office) President Marcos' enactment of the measure amending the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act is expected to boost investor confidence and generate more jobs for...

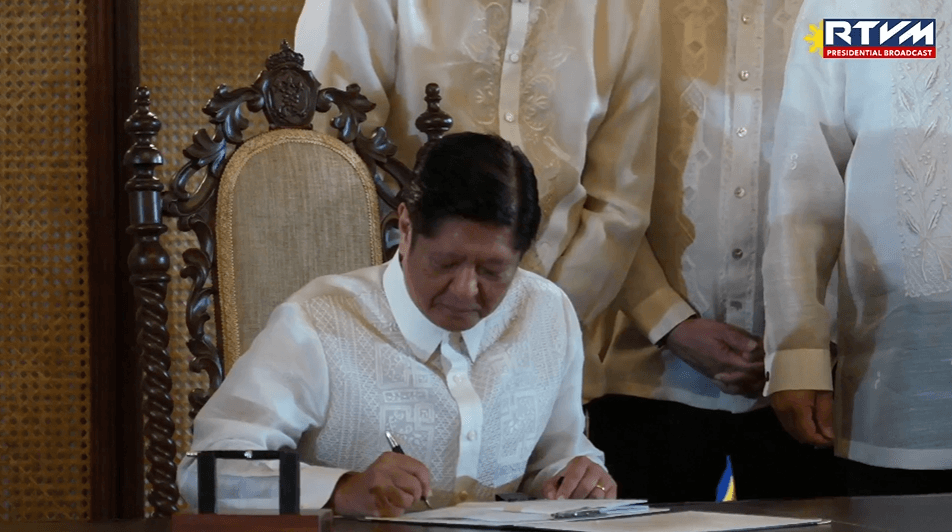

President Marcos signed on Monday, Nov. 11, the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, stressing that it's "a decisive step" towards a globally competitive and investment-led Philippine economy. Marcos said...