Digitalization and microentrepreneurs: Stories of transformation

FROM THE MARGINS

The Bangko Sentral ng Pilipinas (BSP) recently lifted its moratorium on new electronic money issuers from non-bank financial institutions (EMI-NBFIs). This progressive move opens the doors for financing companies, microfinance institutions (MFIs), credit cooperatives, and other non-bank entities to provide e-money services. For small businesses and microentrepreneurs, this means enhanced access to financial tools that can streamline operations and connect them with a broader customer base, both locally and globally.

The power of digital transformation in driving microentrepreneurial success was evident at the 3rd Digital Financial Inclusion Awards (DFIA) last December, where 16 microentrepreneurs shared how e-commerce platforms and digital payments revolutionized their businesses. Their stories are inspiring, testaments to the indomitable power of believing in one’s dream of making a difference.

A journey of passion and purpose

At 31, Hayreen Fe Ecura, a native of Aurora, has built a thriving business while staying true to her values of service and community upliftment. As the owner of Ecura’s Delicacies and Ecura’s Home Kitchenette, she embodies resilience and innovation in the world of microentrepreneurship.

A former college scholar of ASKI APPEND, Hayreen’s early years were marked by her commitment to serving rural communities in Benguet. However, discerning her family’s needs, she returned to Aurora in 2018 and ventured into business.

Starting as a home-based enterprise, Ecura’s Delicacies began with pasalubong products like banana chips, taro chips, and sampaloc candies. Over time, Hayreen diversified their offerings, introducing catering services under Ecura’s Home Kitchenette. Despite challenges during the pandemic, she embraced digitalization, leveraging platforms like Facebook and Shopee to expand her reach. These efforts enabled her to achieve six-digit monthly sales, provide jobs, and support local communities.

Hayreen’s journey is deeply rooted in her faith and passion for helping others. Her vision for Ecura’s extends beyond profitability; she seeks to be a channel of blessings by supporting missions, youth, and community projects. With support from her MFI, Hayreen expanded their business infrastructure, transitioning from a home-based setup to a physical shop. She now dreams of establishing a resto café with full-package catering service, underscoring her belief in the power of small steps toward big goals.

From story-teller to entrepreneur

Teodoro Lamang Jr., fondly called TJ, began his journey as a video producer, weaving stories that inspired and moved audiences. But when the pandemic hit, TJ transformed his craft into an entrepreneurial venture, founding Fat Mama PH, a cloud-based kitchen specializing in artisanal cakes and pastries. Armed with ₱3,000—the remainder of his last paycheck—TJ embarked on a journey that would merge his storytelling roots with the world of business.

Digitalization became the cornerstone of his success. Leveraging social media platforms like Facebook and e-commerce services such as Foodpanda and GrabFood, TJ transformed his kitchen-based enterprise into a thriving brand. By automating processes and adopting digital tools like Konek 2 Card through Card SME Bank, TJ streamlined operations and extended his reach beyond Lipa City. In 2020, Fat Mama PH earned recognition as one of Foodpanda’s Top Restaurants in Lipa.

What began as a single brand has now grown into multiple ventures, including Ben & Mama PH, offering all-day breakfast meals. Partnering with established brands like Bo’s Coffee and Tapa King, TJ's business scaled further, eventually establishing a commissary and employing digital financial tools to make data-driven decisions.

Beyond profitability, TJ’s journey reflects a deep commitment to community. Initiatives like “Fat Mama Gives Back” provide graduation photos to public school students and baking workshops for youth, impacting over 1,100 students to date. TJ’s story exemplifies how passion, digital transformation, and purpose can elevate a humble dream into a flourishing enterprise that inspires and gives back.

Bridging the digital divide

While digital transformation has propelled financial inclusion, many Filipinos remain on the sidelines. Internet access is still limited in remote areas, and economic constraints prevent many families from acquiring gadgets. Additionally, a significant portion of microentrepreneurs operate in the informal economy, lacking access to digital tools and financial resources.

To address these gaps, the government must invest in anti-poverty programs, promote digital literacy, and improve technological infrastructure. Public-private partnerships can accelerate these initiatives. Microfinance institutions, too, must adapt and innovate to reach more unserved and underserved communities, implementing varied entrepreneurial support programs that will catapult their clients’ small businesses to greater heights. A multi-stakeholder approach to entrepreneurship development will go a long way.

Hayreen and TJ’s stories are powerful reminders of what passion, purpose, and digital tools can achieve. They also highlight the importance of inclusive policies and support systems that empower microentrepreneurs. With continued effort, innovation, and collaboration, we can ensure that every Filipino has the opportunity to thrive in a digitally connected world.

Little by little, step by step, we can create a future where no one is left behind.

* * *

“The man who removes a mountain begins by carrying away small stones.” — William Faulkner

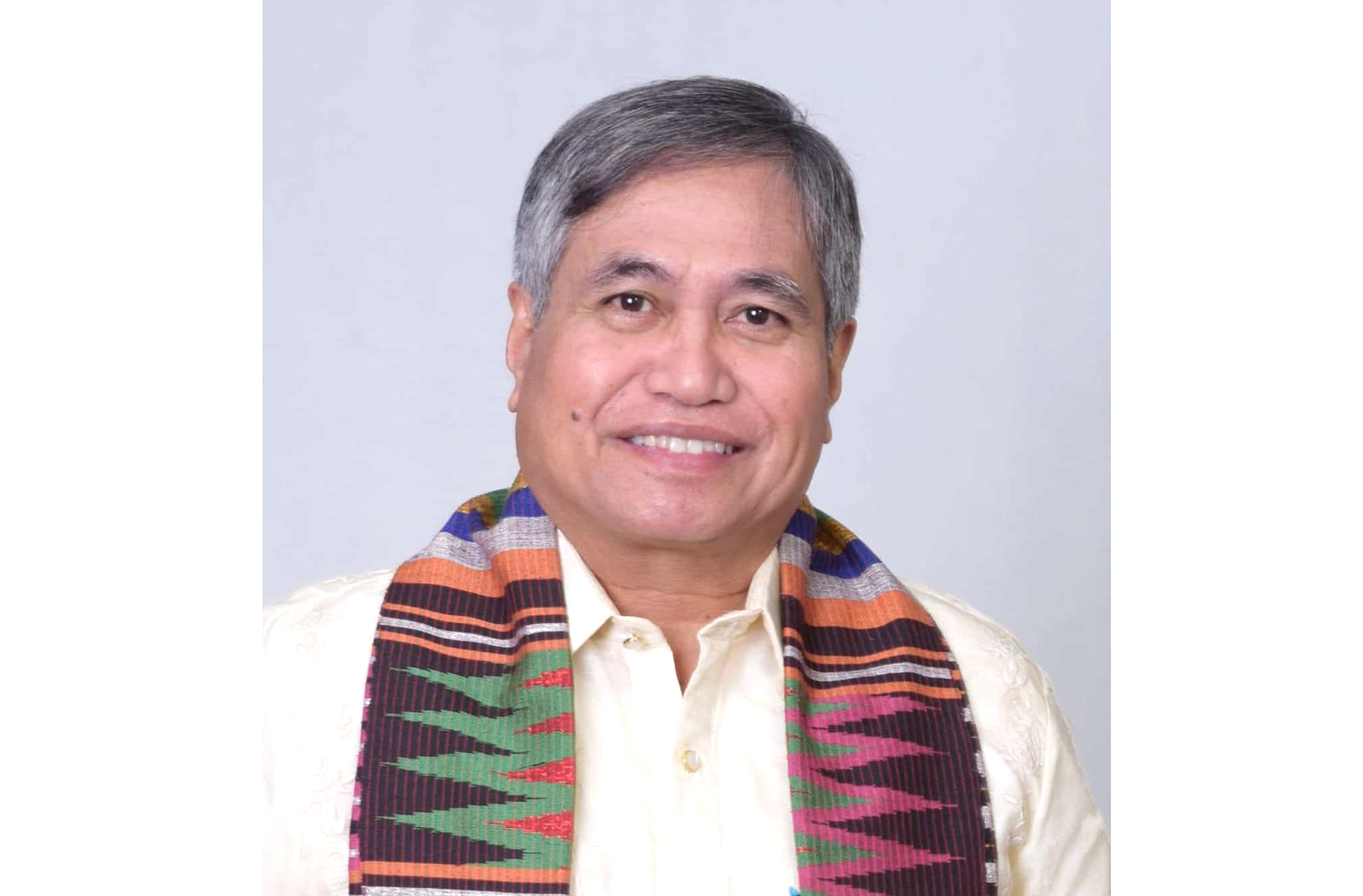

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)