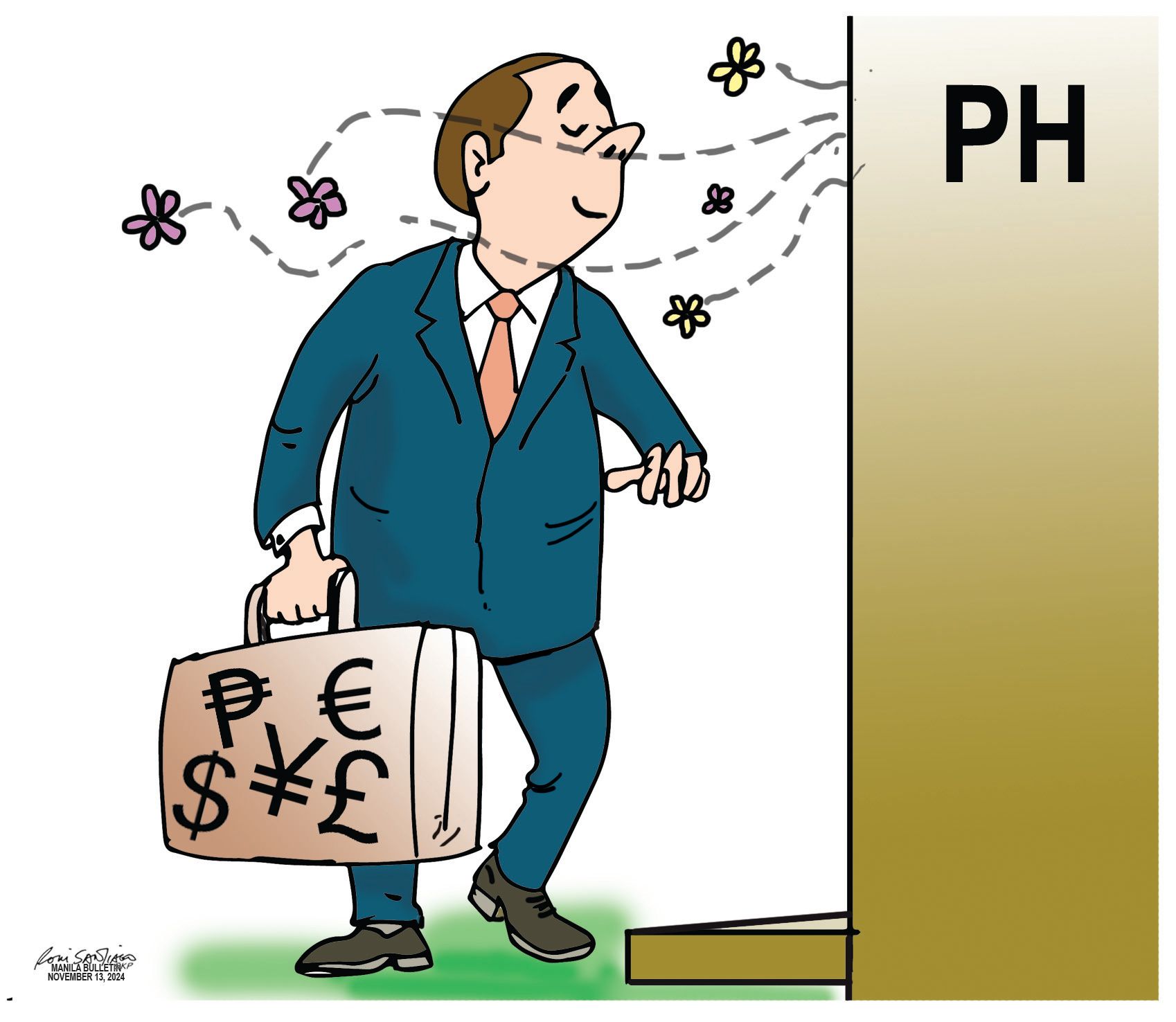

Will the Philippines be the destination of choice for investments in the near future?

Only time will tell, but that’s exactly the objective of the CREATE MORE Act signed by President Marcos on Monday, Nov. 11. The new law aims to make the Philippines a top investment destination by attracting domestic and global investments in strategic industries.

This is why the new law, which amended the CREATE Act, fine-tuned state policies to make the Philippines a more conducive environment for investors to do their business.

The CREATE MORE Act clarifies value-added tax (VAT) and duty incentives, extends them to non-registered exporters and high-value domestic enterprises, and restores VAT incentives for essential business expenses. It also streamlines the approval process, expands tax relief, and offers benefits like reduced income tax rate for corporations from 25 percent to 20 percent, doubled deductions on power expenses, and additional 50 percent deductions for tourism reinvestments and trade fair expenses. It provides tax exemptions for donations to educational institutions, refines the incentive structure, and allows for flexible work-from-home arrangements. Businesses established before the CREATE Act can continue enjoying benefits until 2034 and have until the end of 2024 to register for incentives under the new law.

With these business-friendly provisions — which amended 25 sections and added four new provisions introduced in the National Internal Revenue Code — we look forward to the infusion of fresh investments to boost the country’s economy.

And with the investment capital approval threshold raised from ₱1 billion to ₱15 billion, an influx of investors are expected to come in and do business in the country since under this provision, only those with investments above the ₱15-billion threshold will need to undergo the rigorous process of a review by the Fiscal Incentives Review Board.

As President Marcos stressed at the signing ceremony: “CREATE MORE sets the stage for a business landscape that empowers our enterprises and enhances their growth prospects. By building on the reforms initiated through the CREATE Act, we have enhanced our tax regime [and] incentive framework, and making it more inviting for investment — while remaining steadfast in the principles of fiscal prudence and stability.”

While CREATE MORE is expected to attract investors, the reduction in corporate taxes and the exemptions granted are certain to narrow the country’s revenue base. So, how will the government compensate for these foreseen revenue losses? Will it be in the form of higher consumption taxes? However, raising consumption taxes will severely affect the poor — the sector the government needs to protect because of its vulnerability to economic and climatic shocks.

With this potential problem emerging, we express hope that the government will strike a balance between attracting investments and looking after the welfare of the poor. Addressing the needs of the low-income sector is crucial to economic growth, as poverty and inequality can significantly hinder the country’s economic growth.